Updated July 21, 2020

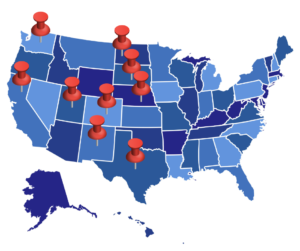

When it comes to Software-as-a-Service (SaaS) companies, there’s often confusion regarding both nexus and the taxability of this revenue stream.

And while the Wayfair decision seems like it’s directed only at online sellers, traditional multi-state sellers (including those that generate revenue from SaaS and software) are also affected, as nexus is now easier to establish. Once it is established – either by traditional physical presence or by sales volume – then companies will need to consider the taxability rules of SaaS in each state in which they have nexus.

Is SaaS even taxable? Because SaaS and cloud computing don’t always clearly fall into existing tax definitions, different states interpret its taxability in different ways. Some regard it as similar to electronically downloaded software, while others consider it a service, which may be taxable or not. And what about electronically downloaded software? Is it treated differently from SaaS?

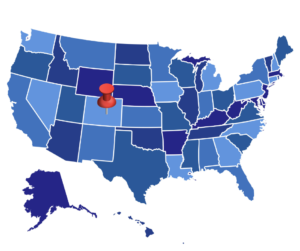

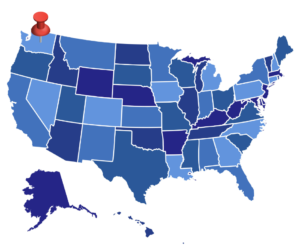

Here’s a guide to the taxability of SaaS in these nine key western (and some mid-western) states:

Find out about the taxability of SaaS in nine key eastern states in this blog post.

1. Taxability of SaaS in California

Economic Nexus Provisions: Yes

As of April 1, 2019, companies with $500,000 in sales establish economic nexus and are required to collect and remit sales tax in this state, as long as they meet the threshold rules in either the current or preceding calendar year.

SaaS and Cloud Computing Tax Rules: Nontaxable

Sales and use tax does not apply to SaaS, which California defines as, “A customer gains access to software on a remote network without receiving a copy of the software, while the seller retains exclusive possession and control of it.” While California has not specifically codified the SaaS revenue stream, the state takes the position that it is akin to electronically downloaded software, which is exempt.

*Electronically Downloaded Software Treatment: Nontaxable

According to California’s statutes, the sale of a prewritten program is not taxable if the program is electronically delivered to the customer and the customer does not obtain possession of tangible personal property (e.g. storage media) in the transaction.

*For the purposes of this article, we are addressing the taxability of pre-written or canned software (not custom software) that is delivered electronically. Custom software is exempt in most states, regardless of the method of delivery.

*SaaS and Cloud Computing vs. Electronically Downloaded Software

In this state, SaaS, cloud computing and electronically downloaded software are all defined as nontaxable in all instances where the customer doesn’t physically obtain tangible property.

*For purposes of this blog article, we address the taxability of pre-written or canned software (vs. custom software), which is delivered electronically. Custom software is exempt from tax in most states, regardless of the method of delivery.

2. Taxability of SaaS in Colorado

Economic Nexus Provisions: Yes

As of December 1, 2018, companies with either $100,000 in gross revenue or 200 separate transactions establish economic nexus and are required to collect and remit sales tax in this state, as long as they meet the threshold rules in either the current or preceding calendar year.

SaaS and Cloud Computing Tax Rules: Nontaxable

In Colorado, computer software is not taxable when delivered through an application service provider, electronic computer software delivery, or transferred by load and leave computer software delivery. This includes SaaS, cloud computing, and information and data processing services.

Electronically Downloaded Software Treatment: Exempt

Prewritten computer software delivered electronically is not subject to tax because software that is delivered electronically is not tangible personal property.

SaaS and Cloud Computing vs. Electronically Downloaded Software

Because Colorado doesn’t define SaaS, cloud computing or electronically downloaded software as a tangible item, all of them are nontaxable/exempt from sales and use tax in the state.

3. Taxability of SaaS in Nebraska

Economic Nexus Provisions: Yes

As of January 1, 2019, companies with either $100,000 in sales or 200 separate transactions establish economic nexus and are required to collect and remit sales tax.

SaaS and Cloud Computing Tax Rules: Nontaxable

This state has not specifically addressed the taxability of cloud computing, although it has released a guide that explains sales for cloud computing and SaaS services are not taxable, no matter where the hardware, software or other network components are located. It is worth noting, however, that the service provider needs to pay sales or use tax on its purchaser of software, hardware and network components if they’re used in-state.

Electronically Delivered Software Treatment: Taxable

Although SaaS and cloud computing services are not taxable in Nebraska, prewritten software that’s electronically delivered to the purchaser is subject to sales and use tax in the state.

4. Taxability of SaaS in New Mexico

Economic Nexus Provisions: Yes

As of July 1, 2019, companies with $100,000 in sales will establish economic nexus and will be required to collect and remit sales tax if they meet the sales threshold requirement in the prior calendar year. There is no transaction threshold.

SaaS and Cloud Computing Tax Rules: Taxable

Services, including SaaS and cloud computing services, are subject to New Mexico’s gross receipts tax, as long as the services are used in New Mexico. For this reason, the taxability of cloud computing services in New Mexico does not depend on the location of servers from which these services are accessed. For instance, charges to use information or data located on a remote server are subject to tax if the information or data is received in New Mexico.

Electronically Downloaded Software Treatment: Taxable

In New Mexico, receipts from the sale or license of prewritten software delivered electronically are subject to gross receipts tax.

SaaS and Cloud Computing vs. Electronically Downloaded Software

New Mexico defines SaaS and cloud computing as services, making them subject to the state’s taxes. Electronically downloaded software is also taxable, however it’s not because it’s considered a service; the state defines it as subject to gross receipts tax rather than sales and use tax.

5. Taxability of SaaS in North Dakota

Economic Nexus Provisions: Yes

As of January 1, 2019, companies with either $100,000 in sales or 200 separate transactions establish economic nexus and are required to collect and remit sales tax.

SaaS and Cloud Computing Tax Rules: Limited Guidance

This state has no official regulations or statutes regarding how sales and use tax applies to cloud computing or SaaS. However, North Dakota imposes sales and use tax on the sale, lease or rental of canned (prewritten) computer software regardless of the method in which it is delivered, be it in tangible form, electronically delivered, or by load and leave. As such, that may be an indication of taxability of SaaS as well.

Electronically Delivered Software Treatment: Taxable

Although North Dakota doesn’t provide any guidance regarding the taxability of SaaS and cloud computing, it does state that prewritten software that’s sold, leased or rented – even when delivered electronically – is subject to sales and use tax. The state also defines electronic delivery as, “Delivered from the seller to the purchaser by means other than tangible storage media.”

6. Taxability of SaaS in South Dakota

Economic Nexus Provisions: Yes (of course – this is the state that started it all!)

As of November 1, 2018, companies with $100,000 in sales or 200 separate transactions establish economic nexus and are required to collect and remit sales tax.

SaaS and Cloud Computing Tax Rules: Taxable

While this state hasn’t directly addressed the taxability of SaaS, it does impose sales and use taxes on all computer software and services. According to the tax code, the services are sourced to the location where the service is provided. South Dakota also imposes sales taxes on fees paid to access a database or network as well as software, programs or computer systems in the cloud.

Electronically Delivered Software Treatment: Taxable

Much like the cloud computing and SaaS tax ramifications, prewritten software that’s electronically delivered is taxable in South Dakota.

7. Taxability of SaaS in Texas

Economic Nexus Provisions: Yes (with prospective enforcement)

As of October 1, 2019, companies with $500,000 in gross revenue will establish economic nexus and will be required to collect and remit sales tax, as long as they meet the threshold rules in the preceding 12 calendar months. The state does not have a transaction threshold.

SaaS and Cloud Computing Tax Rules: Partial Exemption

In Texas, SaaS and cloud computing are considered taxable data processing services. The Texas Comptroller has consistently ruled that providing access to software hosted on a remote server via the internet where a customer may input, retrieve and manage data is a taxable data processing service. Twenty percent of the value of taxable data processing services is exempt from tax, so effectively 80 percent of a company’s SaaS revenue stream is subject to sales tax and must be collected from customers accordingly.

Electronically Downloaded Software Treatment: Taxable

Prewritten computer software is considered tangible personal property in Texas, which means the sale, use, rental or lease of such software is subject to sales and use tax, regardless of the method of transfer.

SaaS and Cloud Computing vs. Electronically Downloaded Software

This state defines SaaS and cloud computing as data processing services, making them subject to the data processing service tax (with 20 percent of the value exempt). While electronically downloaded software is also taxable, the reason is because Texas considers the software to be tangible property as it is stored on an individual’s computer.

8. Taxability of SaaS in Utah

Economic Nexus Provisions: Yes

As of January 1, 2019, companies with $100,000 in gross revenue or 200 transactions establish economic nexus and are required to collect and remit sales tax.

SaaS and Cloud Computing Tax Rules: Taxable

Utah imposes sales and use tax on license fees for remotely accessed prewritten software purchased for use of the software in Utah including:

● Hosted software

● Application service provider software

● SaaS

● Cloud computing applications

The Utah Tax Commission interprets Utah Code to mean that prewritten software accessed by a user in the state is subject to tax without regard to the location of the server. Therefore, the use of prewritten software over the internet that is not downloaded by the purchaser is subject to Utah sales tax.

One exception to this is databases (as of July 1, 2013). Amounts paid or charges to access a database are exempt from sales and use tax as long as the primary purpose for accessing the database is to view or retrieve information. The exemption does not apply to amounts paid or charged for a digital audio work, digital audio-visual work or digital books.

Electronically Downloaded Software Treatment: Taxable

Sales and use tax is imposed on prewritten computer software delivered electronically, and sales, rentals, leases and charges for using prewritten software in Utah are taxable regardless of delivery method.

SaaS and Cloud Computing vs. Electronically Downloaded Software

In this state, SaaS, cloud computing and electronically downloaded software are all defined as taxable.

9. Taxability of SaaS in Washington

Economic Nexus Provisions: Yes

As of October 1, 2018, companies with $100,000 in sales establish economic nexus and are required to collect and remit sales tax. Washington was also an early adopter of marketplace facilitator legislation. As such, large companies which are “marketplaces,” like Amazon, are already collecting the tax. Washington keeps issuing additional guidance regularly, so is a state we’ll want to keep an eye on, too.

Note that Washington also imposes a “Business and Occupation” tax, in lieu of a state corporate income tax. This B&O tax is often confusing for companies because it is reported on a combined tax return with the sales tax, but is a different tax. The B&O also has different economic nexus thresholds than does the sales tax.

SaaS and Cloud Computing Tax Rules: Taxable

Washington considers charges made to consumers for the right to access and use prewritten computer software, where possession of the software is maintained by the seller or a third party, to be a taxable service regardless of whether the charge for this service is on a per use, per user, per license, subscription or some other basis. This service includes the right to access and use prewritten computer software to perform data processing.

Also subject to tax are “digital automated services,” which include services transferred electronically that use one or more software applications. However, taxable digital automated services do not include services that primarily involve the application of human effort by the service provider, such as alarm monitoring systems. Nontaxable digital automated services require an average of the services provided through the expenditure of human effort representing more than 50 percent of the time and cost of providing the services.

Electronically Downloaded Software Treatment: Taxable

Prewritten computer software, regardless of the method of delivery, is generally subject to use tax when it is used in Washington as long as the state’s retail sales tax was not previously paid.

However, separately stated charges for custom software and customization of prewritten software are not subject to retails sales or use tax.

SaaS and Cloud Computing vs. Electronically Downloaded Software

In this state, SaaS, cloud computing and electronically downloaded software are all defined as taxable as well.

Contact Us To Learn More About the Taxability of SaaS

With this article, we try to share a nicely summarized report of many complex issues. Many of our clients deal with SaaS, electronically downloaded software and even custom (or customized) software every day, and the laws can be confusing and inconsistent from state to state.

Do you want to learn more about how multi-state tax issues may affect your business, especially in regards to SaaS, cloud computing and electronically downloaded software? Contact us today! We’re happy to answer your questions.

For additional information and a recent overview of SaaS taxability, please click here.

Miles Consulting Group, Inc. is a professional service firm in San Jose, California specializing in multi-state tax solutions. Our firm addresses state and local tax issues for our clients, including general state tax consulting, nexus reviews, tax credit and tax incentive maximization, income tax and sales/use tax planning and other special projects. To learn more, contact us today at www.MilesConsultingGroup.com.