State Tax Issues Associated with Troubled Companies: Part Two- Sales and Use Taxes

Sales taxes are often overlooked when a company is experiencing an economic crisis. Given that some jurisdictions can have rates over 10%, this can be very costly at a time when a company can least afford this expense. With the exception of bankruptcy situations, there are no “special” rules with regard to sales or use taxes when a company is experiencing financial difficulties. So, how can a troubled company minimize their sales and use tax obligations?

State Tax Issues Associated with Troubled Companies: Part 1- Corporate State Income Tax Issues Associated with Cancellation of Debt Income

As we hear about the increase in bankruptcies and debt restructuring, corporations often assume that the state income tax treatment will mirror that of the Internal Revenue Service. This is far from the truth in many states. In our experience, the state tax consequences are often thought of at the last minute or ignored entirely. In fact, it is not unusual for these issues to be addressed during the preparation of the state income tax returns and are rarely analyzed in depth. We’d rather see our clients be proactive!

Cancellation of Debt

Income from the cancellation of debt (COD) can be excluded from federal income. This is dependent on the level of insolvency. If a corporation has excluded COD income, they are required to reduce tax attributes (net operating losses, credits, capital loss carryovers, basis of property, passive activity loss and credits carryovers and foreign tax credits). Federal rules dictate an ordering of the attribute reduction unless certain elections are made. To the degree you are able to consider the state consequences prior to the execution of any debt restructuring, a corporation may be able to preserve state income tax attributes. Further, in some instances, a state income tax gain could be inadvertently generated, causing a tax liability for state purposes even when none was generated for federal tax purposes.

The Trouble With Home Rule Jurisdictions

Over the past two years following the 2018 Wayfair decision, which has allowed more than 40 states to implement economic nexus legislation, we’ve seen these laws affect retailers in sometimes unexpected ways.

Take, for example, home rule jurisdictions. In a post-Wayfair world, the tax burden they create can come as a rude awakening for retailers and legislators alike.

In an already complex online sales tax environment, where every state has its own economic nexus thresholds and requirements, home rule jurisdictions add yet another layer of complication.

What Is Home Rule Jurisdiction?

In this context, “home rule” refers to local governments, including cities and counties, that are given the authority to establish and levy their own sales taxes, separate from state sales tax regulations.

A handful of states, including Alabama, Alaska, Arizona, Colorado and Louisiana, allow self-administering local tax authorities. Much like economic nexus laws, tax regulations vary wildly between home rule jurisdictions, even within the same state.

What Does This Mean For Retailers?

Ever since the Wayfair decision, retailers have been scrambling to properly comply with economic nexus legislation and correctly collect and remit online sales taxes. For smaller companies that trigger economic nexus through sales thresholds (which also vary depending on the state) but don’t have extensive accounting departments, this new tax burden is daunting.

While there has been progress made to simplify and streamline economic nexus across the country, the regulations remain a drain on resources for many smaller businesses.

As stated above, home rule jurisdictions add an additional level of complexity. The complication comes from three main sources: the regulations themselves, the need to submit separate returns for each jurisdiction and the fact that each jurisdiction can choose to audit the seller.

What States Are Doing To Ease The Tax Burden

To the relief of many retailers, a number of states are taking the burden these home rule jurisdictions create seriously and have regulations to simplify the process.

In Alabama, remote sellers can apply for a Simplified Sellers Use Tax, which allows them to collect, remit and report at a flat 8 percent for all sales into the state. The Louisiana Department of Revenue has a similar program, offering a Direct Marketer Sales Tax Return, with a flat combined rate of 8.45 percent.

In Alaska, the Alaska Intergovernmental Remote Seller Sales Tax Agreement, created by local governments and facilitated by the Alaska Municipal League, serves as a central organization for seller registration, return collection, tax fund distribution and audits.

As the online sales tax environment continues to evolve post-Wayfair, we expect to see additional refinements to economic nexus legislation and home rule regulations from states to make the process easier for both retailers and state agencies.

Do You Have Questions About Home Rule Jurisdictions?

If you have questions about economic nexus or home rule jurisdictions please contact us today. We’re happy to clarify any multi-state tax issues you’re trying to navigate.

Focus on New Jersey

Nicknamed the Garden State, New Jersey is the fourth smallest of the 50 U.S. States. It is also the 11th most populous state.

New Jersey’s most famous city, Atlantic City, is best known for its famous boardwalk. This four-mile-long promenade was constructed in 1870 and to this day remains the place where the majority of the city’s attractions are found. Among its most popular tourist spots is Steel Pier, a carnival-style amusement park that has rides for all ages, including a massive observation wheel with climate-controlled gondolas that gives riders amazing views over the city and the ocean year-round.

What You Need to Know About Virtual Currency

You’re probably familiar with the common question, “Cash or card?” However, over the last decade, a newcomer has entered the race. Virtual currencies, and its subset “cryptocurrencies,” which use cryptography to validate and secure transactions, have exploded onto the scene, offering a brand-new avenue for commerce.

You’re probably familiar with the common question, “Cash or card?” However, over the last decade, a newcomer has entered the race. Virtual currencies, and its subset “cryptocurrencies,” which use cryptography to validate and secure transactions, have exploded onto the scene, offering a brand-new avenue for commerce.

However, similar to the lack of consistency among economic nexus and marketplace facilitator laws, legislation concerning virtual currencies also varies wildly state to state.

A Brief History of Virtual Currency

While most people have at least heard of them at this point, there is still a great deal of confusion regarding virtual currencies, how they work and what exactly they are.

Bitcoin is the most popular form of virtual currency, first introduced in 2009 and valued for the first time in 2010.

The technical details of the currency are complex, but as shared by Investopedia, the most important aspects are as follows:

- Bitcoins are “mined” through complex computer systems which solve “complicated puzzles in an effort to confirm groups of transactions called blocks.”

- When this occurs, miners are rewarded with bitcoins. A distributed ledger called a “blockchain,” records the transactions.

- The currency can then be used to make purchases wherever its accepted.

Bitcoin made headlines several years ago as the value skyrocketed, reaching a staggering $19,783 per unit in December 2017. As of Sept. 1, 2020, Bitcoin is currently trading at $12,019, according to CoinDesk.

Despite Bitcoin’s dominance over the market, it’s far from the only option for those interested in virtual currency. Since Bitcoin’s introduction, over 1,600 cryptocurrencies have followed, each with its own pros and cons.

Federal Regulation of Virtual Currency

On a federal level, all virtual currencies that have, “an equivalent value in real currency, or that acts as a substitute for real currency,” are referred to as “convertible” virtual currency, as described by the IRS. These convertible virtual currencies, when sold, exchanged, used to pay for goods or services or used to hold an investment, are generally subject to tax laws and may be subject to tax liability.

The IRS issued guidance in IRS Notice 2014-21 to, “describe how existing general tax principles apply to transactions using virtual currency.”

Virtual Currencies on the State Level

As mentioned above, there is little consistency when it comes to the way states are handling the taxability of virtual currencies.

One of the most well-known attempts at comprehensive regulations came from New York with its BitLicense framework. Issued by the New York State Department of Financial Services in June 2015, the regulations resulted in what the New York Business Journal termed the, “Great Bitcoin Exodus,” with a majority of Bitcoin companies leaving the state as a result of the strict rules and requirements.

For many other states, current legislation does not specifically include language regarding virtual currencies. However, some of these states, such as North Dakota and New Mexico, have issued guidance regarding the sale, transmission or usage of virtual currencies.

Others, such as Vermont, directly apply existing legislation, such as money transmission laws, to virtual currency.

In regards to paying taxes, Ohio became the first state to allow taxes to be paid with Bitcoin in November 2018. However, the state flipped its stance in October 2019, suspending their program for cryptocurrency tax payments.

Overall, virtual currencies are still in their infancy as far as mainstream usage. However, as more states issue guidance regarding its use, it’s important your business is complying with state and federal regulations should you choose to accept virtual currencies for payment.

Do You Have Questions About Virtual Currencies?

If you have questions about virtual currencies and the tax liability that comes along with them, please contact us today. We’re happy to clarify any multi-state tax issues you’re trying to navigate.

Focus on Idaho

Nicknamed the Gem state, Idaho is the 14th largest, the 12th least populous and the 7th least densely populated of the 50 U.S. States.

Humans may have been present in Idaho as long as 14,500 years ago. Excavations at Wilson Butte Cave near Twin Falls in 1959 revealed evidence of human activity, including arrowheads, that rank among the oldest dated artifacts in North America.

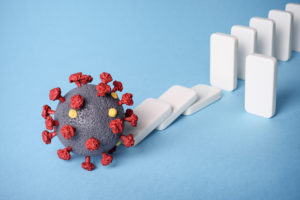

How COVID-19 Is Impacting Wayfair Legislation

In a number of ways, 2020 has been a year of unprecedented change. In the world of online sales and use tax, which has already seen significant change over the last two years, legislation is quickly being adapted to fit the ‘new normal’ that has resulted from the COVID-19 pandemic. More specifically, the fallout of the pandemic has significantly affected Wayfair-related legislation and how it is being applied.

In a number of ways, 2020 has been a year of unprecedented change. In the world of online sales and use tax, which has already seen significant change over the last two years, legislation is quickly being adapted to fit the ‘new normal’ that has resulted from the COVID-19 pandemic. More specifically, the fallout of the pandemic has significantly affected Wayfair-related legislation and how it is being applied.

These laws, which came about after the 2018 Wayfair ruling, have allowed over 40 states across the country to implement economic nexus and marketplace facilitation guidance. In a time when states are looking for ways to make up for lost revenue and to fill budget deficits caused by the pandemic, these laws are prime targets.

Economic Nexus During the Pandemic

As mentioned above, the last two years have seen dramatic change for online sales tax due to the Wayfair ruling. Only two states with a general sales tax have yet to implement some sort of Wayfair-related legislation. However, the pandemic may finally push lawmakers to pull the trigger.

As shared in this article from Avalara, Florida lawmakers introduced an economic nexus bill in August 2019, which progressed through the rest of the year and beginning of 2020, but died in appropriations in March 2020. However, the economic fallout of COVID-19 in Florida, which relies heavily on sales tax collected by in-state businesses, may yet cause lawmakers to change their tune.

Missouri, the other state with a general sales tax that has yet to pass economic nexus legislation, is in a similar situation. The Missouri legislative session ended in May 2020 without a resolution regarding their latest economic nexus bill, but there have been calls by lawmakers for a special session to discuss the possibility of a remote sales tax requirement. Time will tell if this comes to fruition.

Doubling Down On Online Sales Tax Collection

For those states that have already passed Wayfair-related legislation, ensuring the proper collection and remittance of the tax dollars is the focus. We recently wrote about the increased scrutiny on third-party delivery services as a result of the pandemic. The same can be said of retailers in other industries as well.

The pandemic caused an explosion of online shopping during the spring, and as a result, states saw an increase in tax revenue from online sales tax collections. Additionally, many retailers may have triggered economic nexus in more states than they ever have before.

With all this in mind, states are now paying more attention than ever to retailers failing to properly comply with economic nexus or marketplace facilitation requirements and are looking to double down on ensuring compliance to further bolster tax revenue. One specific area of concern is the accuracy and availability of sales tax software. In July, a group of U.S. senators from New Hampshire and Oregon penned letters regarding these concerns and sent them to a number of sales tax software developers.

Economic Nexus and Marketplace Facilitator Thresholds

In late June, Tennessee and North Carolina lawmakers made changes to their Wayfair-related legislation, introducing and subsequently passing the bills in less than two months each.

The Tennessee bill, SB 2932, reduces the sales threshold for economic nexus from $500,000 to $100,000. It will also apply to marketplace facilitators as they’re required to collect and remit Tennessee sales tax on behalf of third-party sellers. The bill will go into effect on October 1, 2020.

North Carolina’s bill, HB 1080, removes any economic nexus threshold for marketplace facilitators that also have a physical presence in the states. Additionally, marketplace facilitators that deal with the sales of food or beverages will need to remit local meals tax. The legislation went into effect July 1, 2020.

While lawmakers may have already been considering these, or other similar changes, the speed at which they were introduced and passed was no doubt influenced by the pandemic and the need for additional sources of revenue.

As the pandemic continues to drag on, we expect similar changes from other states during upcoming legislative sessions.

Do You Have Questions About Economic Nexus Compliance?

If you have questions about economic nexus compliance, or any other tax issues, please contact us today. We’re happy to clarify any multi-state tax issues you’re trying to navigate.

What You Need to Know About the Taxability of SaaS in 6 More States

We recently posted an article about the challenges of SaaS taxability and discussed the reasons why SaaS is a particularly sticky subject, tax-wise.

We recently posted an article about the challenges of SaaS taxability and discussed the reasons why SaaS is a particularly sticky subject, tax-wise.

While there are a number of reasons for it, the complexity largely boils down to irregularities in SaaS definitions between states, little uniformity when it comes to SaaS tax legislation and complication brought about by the very nature of the product (is it a “software” or a “service?”). Economic nexus adds an additional layer of difficulty.

Now, we’d like to give you an in depth look at SaaS taxability in 6 more states.

For SaaS taxability in other states, please follow the links below:

What You Need to Know About the Taxability of SaaS in 9 Western States

What You Need to Know About the Taxability of SaaS in 9 Eastern States

1. Taxability of SaaS in Arizona

Economic Nexus Provisions: Yes

As of 2020, remote companies that make $150,000 in gross sales of tangible personal property or services will trigger Arizona’s economic nexus. Sales made through a marketplace are not included. Starting January 1, 2021, the threshold will lower to $100,000.

SaaS and Cloud Computing Tax Rules: Taxable

Arizona does impose sales and use tax on SaaS and cloud computing. Prewritten computer software or “canned software,” which includes software that may have originally been written for one specific customer but becomes available to others, are also taxable and considered sales of tangible personal property.

Electronically Downloaded Software Treatment: Taxable

Arizona provisions on electronically downloaded software include canned or prewritten software, but custom software is exempt. Customization of canned software is also exempt when the customization is separately stated on the sales invoice.

SaaS and Cloud Computing vs. Electronically Downloaded Software

In a private letter ruling, Arizona defines SaaS as a model in which vendors host software applications and customers access it through the internet. Specifically, in Arizona, SaaS products are leased or paid for on a subscription basis and are then subject to sales and use tax.

2. Taxability of SaaS in the District of Columbia

Economic Nexus Provisions: Yes

As of January 1, 2019, the District of Columbia requires out-of-district retailers with more than $100,000 in gross receipts, or 200 or more transactions into the district, to collect and remit sales tax.

SaaS and Cloud Computing Tax Rules: Taxable

SaaS and cloud computing products are generally subject to sales and use tax in the District of Columbia. Regulations specify system software, application software, computer programming, software modification and software updating are all subject to taxation.

Electronically Downloaded Software Treatment: Taxable

While prepacked and custom software have been taxable in the District of Columbia for some time, emergency legislation passed in 2018, expanded digital sales taxes and gives guidelines that all electronically or digitally delivered, streamed or otherwise accessed digital products are subject to sales and use tax.

SaaS and Cloud Computing vs. Electronically Downloaded Software

The District of Columbia specifies all digital goods, including software, regardless of the method of delivery, are subject to sales and use tax.

3. Taxability of SaaS in Iowa

Economic Nexus Provisions: Yes

Starting January 1, 2019, Iowa requires out-of-state retailers that make $100,000 or more in gross revenue from sales in the state to collect and remit sales tax. Previously, the state also included guidance that economic nexus could be triggered by transaction volume, but that guidance was removed in July 2019.

SaaS and Cloud Computing Tax Rules: Taxable

Iowa does impose sales and use tax on SaaS, cloud-based services or hosting services. However, commercial enterprises are exempt from sales and use tax for prewritten computer software, SaaS and storage of tangible or electronic files when the products are used exclusively or furnished for that enterprise. Additionally, digital products are exempt from sales tax when sold to a “non-end user,” or a person who receives products for redistribution. Other entity-based exemptions are also available.

Electronically Downloaded Software Treatment: Taxable

Starting January 1, 2019, prewritten computer software is subject to sales tax when downloaded electronically, in addition to previous regulations that software was to be taxed when delivered via tangible medium.

Custom software is now subject to the same tax regulations as prewritten software.

SaaS and Cloud Computing vs. Electronically Downloaded Software

SaaS and cloud computing are generally subject to tax, though exceptions are made for commercial enterprises and specific entities. Starting January 1, 2019, specified digital products transferred electronically, including computer software applications, are subject to sales tax.

4. Taxability of SaaS in Mississippi

Economic Nexus Provisions: Yes

Starting September 1, 2018, sales made into the state by remote sellers that are “purposefully or systematically exploiting the Mississippi market” and whose sales exceed $250,000 are required to collect and remit sales tax.

SaaS and Cloud Computing Tax Rules: Taxable

SaaS and cloud computing can generally be considered taxable in Mississippi. While there are no specific provisions that define SaaS, “computer program or software sales and services” are taxable at the regular retail rate of sales tax. Computer program license fees or maintenance contracts are also taxable. However, SaaS is not taxable if the computer servers are located outside of Mississippi.

Electronically Downloaded Software Treatment: Taxable

The definition of “computer programs” include those that are downloaded via the internet, which includes SaaS, canned and customer software and other digital products.

SaaS and Cloud Computing vs. Electronically Downloaded Software

The broad reach of Mississippi tax language and lack of specific definitions means that SaaS, cloud computing and electronically downloaded software are generally considered taxable under the same regulations.

5. Taxability of SaaS in Rhode Island

Economic Nexus Provisions: Yes

Starting July 1, 2019, out-of-state retailers with $100,000 in sales or 200 transactions are required to collect and remit sales tax. The gross revenue from sales of tangible personal property, prewritten computer software delivered electronically or by load and leave, vendor-hosted prewritten computer software and specified digital products are all applicable transactions.

SaaS and Cloud Computing Tax Rules: Taxable

As of October 1, 2018, SaaS and cloud computing are taxable in Rhode Island. Specifically, taxes apply to the “sale, storage, use or other consumption of vendor-hosted prewritten computer software.” Custom software and customization of prewritten computer software are exempt.

Electronically Downloaded Software Treatment: Taxable

Prewritten computer software delivered electronically or by load and leave has been taxable under Rhode Island tax law since 2011.

SaaS and Cloud Computing vs. Electronically Downloaded Software

Rhode Island tax law specifies that vendor-hosted prewritten software, whether downloaded or not, is subject to tax.

6. Taxability of SaaS in Tennessee

Economic Nexus Provisions:

As of July 1, 2019, out-of-state retailers with $500,000 or more in sales made within Tennessee are required to collect and remit sales tax. Starting October 1, 2020, the threshold will lower to $100,000.

SaaS and Cloud Computing Tax Rules: Taxable

In Tennessee, SaaS and cloud computing are considered taxable as of July 1, 2015, as part of the Revenue Modernization Act. The act specifies that it applies to amounts charged for the remote access and use of software, which remains in the seller’s possession, when the purchaser accesses the software within Tennessee.

Electronically Downloaded Software Treatment: Taxable

Prewritten and custom software are both taxable in Tennessee, whether provided via tangible storage medium or electronically downloaded.

SaaS and Cloud Computing vs. Electronically Downloaded Software

In Tennessee, SaaS is defined as software that remains in the possession of the seller but is made available to the customer from a remote location. This means that SaaS is taxable independently of electronically downloaded software, even though both are taxable within Tennessee.

Do You Have Questions About SaaS Tax Compliance?

If you have questions about SaaS tax compliance, or any other tax issue, please contact us today. We’re happy to clarify any multi-state tax issues you’re trying to navigate.

Focus on Virginia

For this month, let’s take a virtual trip to the Mid-Atlantic region of the United States. Commonly known as “The Old Dominion” or “Mother of Presidents”, Virginia was one of the original 13 colonies in the American Revolution and has a vast and storied history. Four of the first five U.S. Presidents were born here, which represents a Virginia Dynasty in national politics. From battles to speeches, to social movements, this land has witnessed to the value of the country. The climate and geography of the state are shaped by the Blue Ridge Mountains and the Chesapeake Bay, providing habitat for much of its flora and fauna.

The Challenges of SaaS Taxability and Why You Should Care

Even without considering the ramifications of the 2018 Wayfair decision, the taxability of software-as-a-service (SaaS) products is complicated. With Wayfair thrown in, it just gets worse.

But why is it so complicated? More importantly, how are SaaS companies supposed to be able to comply with tax laws when they can barely keep on top of them?

A large portion of it comes down to irregularities in SaaS definitions between states, in addition to little uniformity when it comes to SaaS tax legislation. The very nature of the product (is it “software” or “service”) adds to complexity. Over 20 states now assess sales tax on the SaaS revenue stream, but for different reasons.

Why Are SaaS Taxes So Complicated?

In addition to occasionally differing definitions, the laws built on top of those definitions are also different state to state. For example, in New York, all canned or prewritten computer software is considered tangible personal property, and is thus taxable. In others, like Nevada, SaaS is taxable, but only when used for business purposes. Texas classifies SaaS as information services and assesses tax on 80% of the cost (rather than 100%).

SaaS companies who have customers in a number of different states have to deal with these irregularities and keep up with evolving legislation. For companies based in states that do not tax SaaS, such as our home state of California, they can often be lulled into a false state of security and disregard SaaS taxes all together. Clients often tell us that they didn’t realize SaaS was taxable anywhere else because California is usually so aggressive, and if they don’t tax it, others likely don’t either. Unfortunately, that’s not correct. Further, the concept of taxing “the cloud” is also not necessarily intuitive to people who are used to dealing with tangible items you can hold in your hand!

Previously, many of our clients had physical presence in only a handful of states. Now, due to Wayfair, economic nexus can kick in (which is different state to state and is typically dependent on sales and transactions thresholds) and require these companies to collect and remit sales tax on their SaaS products in states where they do not have physical presence.

Additionally, many states with major technology hubs, such as Washington, Texas, Massachusetts and Pennsylvania, do impose sales tax on SaaS, often catching companies by surprise.

How Does Economic Nexus Specifically Impact SaaS Companies?

Beyond requiring SaaS companies to collect and remit sales tax for sales in states where they meet nexus thresholds, economic nexus often hits these companies particularly hard due the monthly subscription fee model, which is popular within the industry. Many states have an “either/or” threshold for creating nexus with a minimum dollar threshold OR a limit of just 200 transactions before economic nexus kicks in, meaning SaaS companies only need 16 customers in a single state before they hit the annual transaction threshold.

For larger companies, which offer SaaS products on an enterprise scale, just one sale can be enough to hit gross sales thresholds (often around $100,000) and trigger economic nexus.

What Happens When Economic Nexus Is Triggered?

It’s easy to see how quickly SaaS companies can find themselves in sticky tax situations due to the interplay between SaaS and economic nexus. While sales tax is a pass-through tax and is not paid for by the seller, it does become a liability if the seller fails to collect. We often remind potential clients that it’s not their tax liability, but the obligation to collect it falls on a seller who has created nexus in the state. So, if a SaaS company suspects they have triggered economic nexus, what do they need to do about it?

The first step is to determine where nexus has been triggered, how long it’s been in effect and the dollar amount of potential exposure for sales tax. At Miles Consulting, this is something we typically do for clients as they look to determine any retroactive liabilities. Often these issues come up as part of a first-time financial statement audit, a cash infusion by investors or an M&A transaction. These issues are generally discovered as part of due diligence work. However, we recommend that companies examine these issues BEFORE a due diligence because then they have more time to resolve them – before quick deadlines cloud the issue.

Next, we help companies with voluntary disclosure agreements, which allow companies to come forward and pay outstanding liabilities before they are identified for an audit by the state. Proper handling of voluntary disclosures often reduces penalties and limits the lookback period to three or four years.

We can also assist SaaS companies by following up with past customers about possible retroactive collection. The most important function of SaaS taxability compliance is to catch liabilities quickly, which is our specialty. We can then help the companies to move forward in the most effective way possible

Do You Have Questions About SaaS Tax Compliance?

If you are curious about SaaS tax compliance, or have other tax questions, please contact us today. We’re happy to clarify any multi-state tax issues you’re trying to navigate.

For more information regarding SaaS taxability in specific states, please follow the links below:

What You Need to Know About the Taxability of SaaS in 9 Western States

What You Need to Know About the Taxability of SaaS in 9 Eastern States

What You Need To Know About the Taxability of SaaS in 6 More States