The Chicago Lease Tax: Important Details For SaaS Companies

Understanding sales tax compliance for SaaS companies is difficult. Some states tax it, some don’t. But what about cities?

Although Illinois doesn’t tax SaaS at the state level, Chicago’s Personal Property Lease Transaction Tax (or Chicago lease tax) is one that these types of businesses need to know about. While it’s not a sales tax, it’s applicable to any entity leasing personal property – including cloud services – to customers in the city.

What Is The Chicago Lease Tax?

Chicago’s lease tax applies to businesses or individuals that either have a lease or lease out personal property that’s used in the city.

Why not just charge a sales tax like other jurisdictions? As the Chicago Bar Association’s Samantha Breslow explains on BloombergTax.com, “Chicago is barred from taxing services, causing it to develop tax rules capturing transactions for the usage of property through a lease or license.”

Economic Nexus and Exempt Sales?

If you’re an avid reader of our blog, you know that economic nexus is the hot topic when it comes to determining if a company has created taxable presence in a state. Since the Supreme Court’s decision in South Dakota v. Wayfair Inc. in June 2018, we’ve been helping clients to make sense of this somewhat confusing concept. While physical presence nexus (employees, inventory, office space) in a state is also still in play and creates a filing requirement, companies find themselves tripping into nexus much more quickly now because of the sales and transaction thresholds of economic nexus legislation, which varies from state to state.

Background

Any company that sells products into a state and exceeds

that state’s economic nexus threshold (either based on volume of sales or

number of transactions), needs to register in that state, collect and remit

sales tax to the state. Companies that make some sales into a state but do not

exceed the state’s threshold, do not need to immediately register, collect and

remit sales tax. But we recommend that clients monitor the thresholds (which

are often $100,000 of sales OR 200 transactions, but often vary) in any state

where they have significant sales transactions.

New State Tax Laws Effective October 1, 2019: What You Need To Know

Are you curious what state tax updates are on the horizon? October 1, 2019 is a big date coming up; numerous states have new online sales tax provisions, amnesty programs and other legislative changes going into effect in just a few weeks. Keep reading for a quick summary of new laws and programs to keep an eye out for beginning next month.

Alabama’s Simplified Sellers Use Tax

As of October 1, Alabama requires remote retailers selling more than $250,000 in total sales (taxable and nontaxable) to begin collecting and remitting sales tax. Although sellers need to file their Alabama state tax returns monthly, these sales and use taxes fall into the “simplified” category because they’re a flat 8 percent on all purchases, regardless of the shopper’s locality in the state.

Focus on South Carolina

South Carolina is a state in the Southeastern United States

and the easternmost state of the Deep South. The state can be divided into

three geographic areas. From east to west: the Atlantic coastal plain, the

Piedmont, and the Blue Ridge Mountains. Locally, the coastal plain is referred

to as the Low Country, and the other two regions as the Midlands and the

Upstate respectively. The Atlantic coastal plain makes up two-thirds of the

state. Its eastern border is the Sea Islands, a chain of tidal and barrier

islands.

The state has a humid subtropical climate, although high

elevation areas in the upstate area have few subtropical characteristics than

areas on the Atlantic coastline. In the summer, South Carolina is hot and humid.

Winter temperatures are much less uniform in South Carolina. Snowfall is

somewhat uncommon in most of the state, while coastal areas receive less than

an inch annually on average.

Important State Tax Requirements You Need to Know for Recreational Marijuana

The cannabis industry has grown over the past several years as more states have legalized recreational use. This means that new companies are popping up to fill the demand, translating to higher revenue from the additional state and local business taxes.

What exactly do state tax requirements look like for the cannabis industry? This guide will provide a quick overview of the states where recreational marijuana is currently legal.

Alaska’s State Tax Requirements for Marijuana

State tax rates for retail cannabis actually increased in Alaska earlier this year. As of January 1, 2019:

- Mature buds or flowers are taxed at $50 per ounce

- Trim is taxed at $15 per ounce

- A bud or flower that is considered immature or abnormal (because it didn’t fully develop, it contains seeds or it failed testing) is taxed at $25 per ounce

- Clones are taxed at a flat rate of $1 per clone and not included on the estimated weight

Introduction to the California Cannabis Industry

The cannabis industry is the new hot evolving industry in CA.

California became the first state to legalize medical marijuana in 1996. On

November 8, 2016, the state’s voters chose to legalize recreational use of

marijuana.

The California Tax and Fee Administration (CDTFA) has put together an online guide to help business owners better understand the tax obligations specific to their cannabis business. In the following article, we will summarize these nuances that business owners need to know about this industry. Also, stay tuned for future articles on this topic.

What You Need to Know About Sales Tax Holidays

Although not all states offer sales tax holidays to consumers, 17 states across the country (as well as Puerto Rico) currently offer specific dates where shoppers can buy certain items without paying the sales tax on them. While they’re designed as an incentive for consumers to support local businesses, and they’re an interesting approach some states take, it’s difficult to know if they’re really all that effective in driving the local economy – plus these holidays can cause quite a headache for retailers.

Which States Offer Sales Tax Holidays?

Avalara has a nice list of all the 2019 sales tax holidays by state, but here’s a quick summary:

- Alabama: Severe weather preparedness, February 22-24 and back to school, July 19-21

- Arkansas: Back to school, August 3-4

- Connecticut: Clothing and footwear, August 18-24

- Iowa: Clothing and footwear, August 2-3

- Florida: Disaster preparedness, May 31-June 6 and back to school, August 2-6

- Louisiana: Second Amendment (e.g. ammunition and firearms), September 6-8

- Maryland: Energy efficiency (Energy Star products), February 16-18 and Shop Maryland Tax-Free Week (apparel, footwear, backpacks and book bags), August 11-17

- Massachusetts: Single items of tangible personal property, August 17-18

- Mississippi: Clothing and footwear, July 26-27 and Second Amendment, August 30-September 1

- Missouri: Energy efficiency, April 19-25 and back to school, August 2-4

- New Mexico: Back to school, August 2-4 and small businesses, November 30

- Ohio: Back to school, August 2-4

- Oklahoma: Clothing and footwear, August 2-4

- Puerto Rico: Back to school, January 4-5

- South Carolina: Back to school and bed & bath items, August 2-4

- Tennessee: Back to school, July 26-28

- Texas: Emergency preparedness, April 27-29, energy and water efficiency, May 25-27 and back to school, August 9-11

- Virginia: Back to school, energy efficiency, emergency preparedness and more, August 2-4

Focus on Washington

Washington is a state in the Pacific Northwest. It is the 18th

largest state and the 13th most populous state. The state was

admitted to the union as the 42nd state in 1889.

The Puget Sound in Washington is an inlet of the Pacific

Ocean consisting of numerous islands, deep fjords, and bays carved out by

glaciers. The remainder of the state consists of deep temperate rainforests in

the west; mountain ranges in the west, central, northeast and far southeast;

and a semi-arid basin region in the east, central and south, given over to the

intensive agriculture. Washington is the second most populous state on the West

Coast, after California. Mount Rainier, an active stratovolcano, is the state’s

highest elevation, at almost 14,411 feet, and is the 2nd

topographically prominent mountain in the continental United States, the first

being Denali in Alaska.

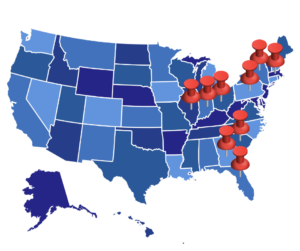

What You Need to Know About the Taxability of SaaS in 9 Eastern States

Updated July 21, 2020

Are you curious if you need to be paying taxes on or charging your customers sales tax on your sales of these revenue streams: Software-as-a-Service (SaaS), cloud computing and electronically downloaded software? The answer is, maybe. Because these three areas are defined differently by each state, it’s important to understand how each state’s tax codes approaches them.

Being aware of the tax ramifications in any state your company has established nexus is incredibly important, especially considering last summer’s Wayfair decision. While the U.S. Supreme Court’s decision may seem like it was only directed at online sellers, the truth is that multi-state sellers (such as those generating revenue from SaaS and software) are also affected. Because of the ruling, it will be even easier to establish nexus in more states across the country; companies need to know which taxes they’re responsible for in regards to SaaS, cloud computing and electronically downloaded software.

Here’s a guide to the taxability of SaaS in these nine key eastern states:

California: Relief for Marketplace Sellers?

The state of California is at it again! But this time offering some relief for out of state sellers. In a continuing quest to require out of state sellers who created nexus as a result of engaging in programs like Fulfillment by Amazon (FBA) to register and retroactively file in the state, CA has passed SB 92 and the California Department of Tax and Fee Administration (CDTFA) has issued guidance. On July 1, 2019, the CDTFA issued Special Notice L-681 pertaining to Senate Bill 92 that discusses a special tax relief program. This program is only available for “qualifying retailers.”