Why Should Businesses Be Cautious of the New Sales Tax Bill?

As we shared last week, Congress recently introduced two new online sales tax bills: Sensenbrenner's H.R. 5893, which would make it harder for states to impose sales tax, and Goodlatte’s Online Sales Tax Simplification Act of 2016, which would make it much easier.

Goodlatte’s State Tax Clearinghouse

One concept in Goodlatte’s sales tax bill that’s worth exploring more is the clearinghouse concept.

According to the proposal, “A state may impose a sales, use or similar tax on a seller, or impose on a seller an obligation to collect such a tax imposed on a purchaser, with respect to remote sale of a product or service only if —

- The State is the origin State for the remote sales (where the company had the most employees during the previous calendar year);

- The tax is applied using the origin State’s tax base applicable to non-remote sales; and

- The State participates in the State tax clearinghouse.”

Online Sales Tax Debate- Still Going On?

For several years, the online sales tax debate has been tossed around Capitol Hill, but has gained little traction in Congress. However, two new bills introduced recently add some new fodder for discussion. One bill makes it harder to impose sales tax, while the other makes it much easier. Will either pass?

No Regulation Without Representation

Representative Jim Sensenbrenner, a republican from Wisconsin, introduced a new bill to Congress in July that would prevent states from taxing any seller lacking a physical presence. This bill is called the No Regulation Without Representation Act of 2016 (H.R. 5893).

Under this bill, unless the person is physically present in a given state during the relevant tax period, a state may not obligate a person to:

- Collect a sales, use or similar tax

- Report the sale

- Assess a tax on a person

- Treat the person as doing business in a state for purposes of such tax

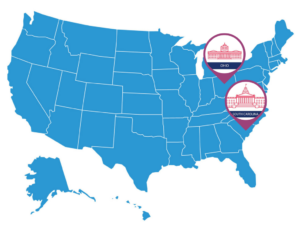

Nexus News: The Latest from Ohio and South Carolina

As lawmakers continue to debate how to make online sales tax feasible for the whole country, the issue of nexus continues to reign supreme for states attempting to increase their revenue from internet retailers. The latest in nexus news comes out of Ohio and South Carolina, two states that recently released details about how nexus is defined in their states.

Ohio's Statutory Changes to Nexus

Earlier this month the Ohio Department of Taxation released statutory changes that broaden how the state defines "substantial nexus," which means out-of-state retailers could be held responsible for the state’s sales and use tax.

Similarly to Washington State, which expanded the definition of nexus last fall, Ohio’s update includes click-through and affiliate nexus provisions. Read more

Pennsylvania Tax Law Changes

Pennsylvania, like many other states, is adjusting its tax statutes to include more goods and services within the taxable definitions. Following recent changes to its somewhat confusing new legislation, the state issued a ‘clarifying’ bulletin for use in interpreting the new requirements. In this blog, we will discuss a few areas of this clarification as well as an amnesty program available to some businesses.

Electronically or Digitally Delivered Items (i.e., Digital Downloads)

This new Sales, Use & Hotel Occupancy Tax Bulletin 16-001, was drafted on July 21, 2016 and became effective on August 1, 2016. This bulletin clarifies recently enacted legislation related to digital products. The legislation applies a tax regime to many of the newly created revenue streams developed by the digital industry. Unlike the traditional taxes on things we can touch and feel (i.e. tangible property) lawmakers want to expand the tax revenue base to ‘new age’ things. As you might expect, the attempt to do so has resulted initially in some confusion. The bulletin is an attempt to clarify the new legislation. It explains that a state sales and use tax is imposed on electronically or digitally delivered, streamed or accessed video, photographs, books, any other taxable printed matter, applications (i.e., “apps”), games, music, any other audio, including satellite radio service, canned software, or any other otherwise taxable tangible personal property. Additionally, updates or support on these items are also taxable.

Revisiting the California Competes Tax Credit Program

Do you operate a business in California? Have you taken advantage of the state’s tax credits offered through the California Competes program? The truth is, this program is showing itself to be very difficult for companies to actually receive benefits from.

As Susan Shelley, columnist for the Los Angeles Daily News, explains:

How does a business qualify for the California Competes tax credit and how much money can it save on taxes? There doesn’t seem to be a clear answer. “Tax credit agreements will be negotiated,” the [Governor’s Office of Business and Economic Development] website states.

The negotiating is done by the governor’s appointees at GO-Biz, then approved by the California Competes Tax Credit Committee. The CCTC committee is made up of the state treasurer, the director of the Department of Finance, the director of GO-Biz, one person appointed by the Assembly Speaker, and one person appointed by the Senate Rules Committee.

They meet several times a year to consider applications…one after another, company representatives are brought before the committee to be grilled about their application for a tax credit.

Shelley goes on to explain that the questions asked are harsh – so harsh that California Compete’s legal counsel was brought in to tell the committee they are limited regarding types of data they collect, especially when it comes to company demographics. However, the Assembly’s political appointee hired their own legal counsel to insist that the tax credit program could be used for the state legislature to, “pursue other ‘underlying goals.’”

I don’t know about you, but I’d like to see the program be more objective, less subjective, and more transparent. Companies applying for the credit currently receive little guidance on how to draft a success application, and while 25% of the funds are supposed to go directly to small businesses, they are precisely the types of companies that often don’t have the wherewithal to apply.Read more

Focus on Vermont

The gold standard for fall foliage takes us to Vermont. With 75% of the state covered in forest and having the most land coverage of maple trees per capita, Vermont’s foliage season is the most vibrant. With its thousands of acres of alpine terrain, it is a popular destination for snowboarders and skiers. Trout fishing, lake fishing, ice fishing and hunting are also popular pastimes for residents and tourists alike. In the fall, hikers can catch some unforgettable views.

Vermont is attractive for more than just its environment. Vermont is also known for the manufacture and sale of artisan foods, fancy foods and novelty items such as Cabot Cheese, the Vermont Teddy Bear Company (where visitors can build their own Teddy Bear), Burton Snowboards and Ben and Jerry’s Ice Cream (where tours end by tasting your favorite flavor). Read more

Companies Looking to Acquire: Why Worry About Sales Tax?

A couple of weeks ago we took a look at what controllers and CFOs need to think about prior to their company being acquired. But what if you’re looking to acquire another business?

How Sales Tax Affects Mergers & Acquisitions

Because sales tax is a gross tax, it can’t be offset by net operating losses like income tax can. This is why larger acquirers begin the process by analyzing the target company’s potential outstanding tax liabilities they’d be taking on. If the business they’re looking to acquire hasn’t thought through the ramifications of multistate sales tax issues, it can either completely derail the deal or negatively impact the final purchase price.Read more

Nevada Tax Law Changes

In 2015, Nevada’s legislature was busy enacting controversial legislation aimed at raising revenue in the state. These laws are yet another challenge for businesses.

Last year, Senate Bill (SB) 483 was signed into law by Governor Sandoval and became known as the “Commerce Tax.” This new law went into effect on July 1, 2015 and applies to businesses whose Nevada gross revenue in a taxable year exceeds $4,000,000. Under the law, a “business entity” is defined as a corporation (both S and C), partnership, LLC and sole-proprietorship (i.e., those who file schedule C), just to name a few. For a complete list of the business entities subject to the Commerce Tax, click here. Note that out of state companies are also subject to the Commerce Tax to the extent that they have nexus in Nevada.

This law was enacted a year ago, but the effects of it are now being seen by companies whose first Commerce Tax return is due for the year ended June 30, 2016. This tax must be remitted to the state within 45 days after the end of the taxable year (August 15, 2016). Companies may file an extension for 30 days, to allow them more time to comply with the new law. All Nevada business entities are required to file the return, even if total revenue is less than the $4,000,000 minimum.

Companies Looking to be Acquired: Why Worry About Sales Tax?

Although it may not seem like sales tax has much to do with mergers and acquisitions, the truth is, many deals have fallen apart because of multistate sales tax issues. Controllers and CFOs who have seen the process first-hand know how messy the acquisition process can be – particularly if the target company’s multistate tax issues (especially sales taxes) haven’t been addressed.

How Does Sales Tax Affect Mergers & Acquisitions?

As a company looking to be acquired, it’s important you work with a firm that specializes in this area; this can help you identify and mitigate some of the potential problems before the deal closes. If you’re considering an acquisition in the next year or two, we highly suggest a nexus, taxability and potential exposure review prior to a bigger company calling and performing their own due diligence. This is definitely a case where knowledge is power!

Why Should the CFO or Controller Care?

Although CFOs and Controllers have a lot of financial experience, dealing with all the sales tax rules is likely to be outside their wheelhouse. There are so many things to consider in an M&A deal, and making sure both parties are following all merger and acquisition provisions can be difficult – especially considering that not all states follow the federal standards. The sales tax consequences are often forgotten until the very end – when it may be too late to proactively deal with them!Read more

FOCUS ON IDAHO

This month, we travel west to Idaho, the 14th largest state in the U.S. Known for its mountainous landscapes, vast swaths of protected wilderness and outdoor recreation areas, Idaho is bigger than all of the New England states combined. Boise, the capital and largest city, is set in the Rocky Mountain Foothills and is bisected by the Boise River, a popular destination for rafting and fishing.

Although Idaho is best known for its great fishing, other outdoor recreational adventures attract people to mountain biking at the Schweitzer Mountain Resort, and jet boating on the Snake River. Rafting and Kayaking are also popular activities. Idaho is ranked number one in the U.S. and in the world for whitewater adventures by Outdoors Magazine. And for something on the calmer side, excellent golf courses await throughout Idaho. Idaho has more than 100 golf courses nestled amongst the gorgeous Idaho landscape.

Business Climate

Idaho is a prominent agricultural state. Nearly one third of the nation’s potatoes are grown in the state. Additionally, all three varieties of wheat are grown in Idaho: dark northern spring, hard red and soft white. But Idaho is more than outdoor recreation and farming. Some major industries include food processing, lumber and wood products, machinery, chemical products, paper products, electronics manufacturing, silver and other mining and tourism.

Recently, Idaho expanded its commercial base as a tourism and agricultural state to include the science and technology industries. Science and technology have become the largest single economic center (over 25 of the state’s total revenue) within the state and are greater than agriculture, forestry and mining combined.

Tax Climate

Idaho is the 10th highest of states in the U.S. that levy an income tax. Idaho’s individual income tax system consists of seven brackets with a top rate of 7.4%. Corporations based in Idaho must pay a corporate income tax at a flat rate of 7.4%. Among all of the states in the country, this corporate rate is the 19th highest.Read more