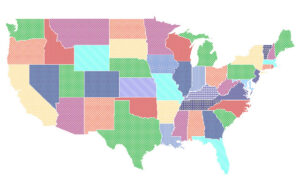

Top States for Doing Business 2014

There are different approaches when it comes to picking the best state to expand your business into. While some owners select a location based on credits, incentives and state tax laws, others make the decision weighing factors like infrastructure, access to transportation and quality of life. What if you want to consider all the various factors? Area Development recently ranked the top states for doing business based on a survey of site selection consultants.

Top States for Doing Business – Survey Results

Area Development’s survey factored in three main areas:

- Overall business environment (such as cost of doing business and incentive programs)

- Labor climate (like competitive labor costs and availability of skilled labor)

- Infrastructure and global access (such as competitive utility rates and water outlook)

California Film Tax Credits

Film Industry in California

Hollywood California has long been considered the movie capital of the world. Historically, the state has been a great location for filming due to its landscape and weather conditions and eventually numerous motion picture studios began appearing in the area. The movie industry has developed substantially since its early beginnings and so has its costs. Pairing these rising costs with the additional tax ramifications businesses face within California, film studios began filming elsewhere. Since 2004, the state has lost over 18,000 jobs within the film and television sector.

California’s Expanded Tax Credit Program

Today, other states have become more appealing locations to film for several reasons, including not just movie settings but also financial purposes. Although there are still plenty of movies being filmed in California, the film industry is not as prominent in the state as it used to be. Thus, in February 2009 California created the California Film & Television Tax Credit Program to increase film and television production, jobs and tax revenue.

This program, administered by the California Film Commission (CFC), provides a tax credit equal to 20-25% of a company’s income tax and/or sales and use tax for eligible film and television productions. Qualified productions must film at least 75% of principal photography days or 75% of the budget must be spent in the state. If the tax credit is used for income tax purposes they are nonrefundable and carried forward for 5 years and can be transferred to an affiliate. Motion pictures considered to be a qualified “independent film” (less than $10 million budget) are allowed to transfer or sell their tax credits to an unrelated party. In addition, $10 million in tax credits is reserved for independent films. The application process requires providing supporting documents to prove eligibility and filling out necessary information and production information (e.g. type of production, schedule to film, and number of principal photography days). After this the CFC will review the applications and, if selected, issue a certificate for the tax credit.Read more

The Marketplace Fairness Act: What’s New?

A few months ago we introduced the Marketplace Fairness Act and explained what it is, how it could affect your business and why you should care about the outcome. At Miles Consulting, we've been keeping a close eye surrounding this legislation.

4 Updates Surrounding the Marketplace Fairness Act

Here's the latest you need to know about the Marketplace Fairness Act:

1. Polling data shows that 70% of Americans support legislation requiring sales-tax collection. When you compare the numbers to polls conducted in previous years, they show the public is increasingly supportive of bills like the Marketplace Fairness Act.

Our take: Would 70% of Americans support this legislation if they understood how it would affect small businesses? Or that with the passage of the legislation they’d be charged sales tax on all online purchases? If so, we think the polls might read differently.Read more

Focus on Ohio

The aesculus glabra is a tree species that contains a poisonous fruit that Native Americans would call “hetuck,” meaning eye-of-the-buck due to its resemblance to a buck’s eyes. The tree was eventually termed an Ohio Buckeye and is the state tree. In this week’s blog we focus on the Midwest state of Ohio.

The aesculus glabra is a tree species that contains a poisonous fruit that Native Americans would call “hetuck,” meaning eye-of-the-buck due to its resemblance to a buck’s eyes. The tree was eventually termed an Ohio Buckeye and is the state tree. In this week’s blog we focus on the Midwest state of Ohio.

Business Climate

Ohio has the seventh largest state economy in the nation, based upon their 2013 GDP of $565 billion. The state’s success is a result their two leading industries; manufacturing and exporting.

Manufacturing is the state’s largest of twenty sectors, which accounts for $99.8 billion or 17.7% of the GDP. Ohio contributes 4.4% of America’s total manufacturing output, making them the 4th highest behind California, Texas, and Illinois. This sector currently employs over 673,000 people. Ohio leads the nation in production of plastics, rubber, fabricated metals, electrical equipment, and appliances.

The state has become the 9th largest exporting state in the nation due to its extensive railroad network, five international airports, and eight interstate highways. Ohio is geographically located within 600 miles of more than half of the U.S. and Canadian populations. In 2013, Ohio’s top exported commodity was machinery ($9.3 billion). Other top export commodities include vehicles, aircraft, electrical machinery, plastics, and optics. In 2012, over 16,000 companies exported from Ohio.

Taxes

Ohio is rated unfavorably on the 2014 State Business Tax Climate Index ranking at 39 out of 50. Their individual income tax (44th) and sales tax (30th) ranked poorly in comparison to other states. Governor John Kasich has tried to relieve the burden since taking office by creating tax reductions and reforms that reduced personal income taxes, created a new Earned Income Tax Credit, cut small business taxes in half and eliminated the death tax.Read more

The California Competes Tax Credit Program

The California Competes Tax Credit Program is in full swing. In this article we review the basics about this incentive program as well as important facts and dates to take into consideration.

What Is The California Competes Tax Credit Program?

Earlier in 2014, the State of California announced the innovative California Competes Tax Credit program. The program was implemented to offer California-based businesses an income tax credit if they’re looking to expand, or for non-California organizations looking to relocate to the Golden State.

The project has several phases, and applications from businesses go through a review process to determine which opportunities best meet the state’s objectives for economic development, and to allocate funds to companies that best carry out those objectives.Read more

It's October - think pink for a cause

To all my readers who follow us for state tax consulting blogs, this one is going to be a departure. I’d like to dedicate this blog to something ELSE that keeps me busy this time of year – raising money for the American Cancer Society’s Making Strides Against Breast Cancer. I’ve been participating in this event for the last 16 years and have raised over $150,000 during that time! All of my donations received over the years have been from individuals – friends, family, and clients that honored my fundraising efforts with a generous donation. Over the years, I’ve accepted donations ranging from $10 to $1,000 at any one time. And, while the big donations are AWESOME, I also appreciate the small ones. They often represent the biggest amount that the person can afford to give.

To all my readers who follow us for state tax consulting blogs, this one is going to be a departure. I’d like to dedicate this blog to something ELSE that keeps me busy this time of year – raising money for the American Cancer Society’s Making Strides Against Breast Cancer. I’ve been participating in this event for the last 16 years and have raised over $150,000 during that time! All of my donations received over the years have been from individuals – friends, family, and clients that honored my fundraising efforts with a generous donation. Over the years, I’ve accepted donations ranging from $10 to $1,000 at any one time. And, while the big donations are AWESOME, I also appreciate the small ones. They often represent the biggest amount that the person can afford to give.

While not all of my readers may be supporters of this particular philanthropic endeavor, I thought I’d publish a list of my favorite fundraising tips – for any of you that might be fundraising for your special charity. These are the things that I have found helpful in my quest to raise as much money as possible to fight breast cancer.

Fundraising Ideas

1. Set a goal and share it with everyone you know. This year, I am trying to raise $15,000. That’s no small feat. So, I’m sharing it with everyone I know – through emails, phone conversations, and in person. People who care about us want to help us reach our goals – particularly those related to a good cause. Right now, I’m 25% of the way to my goal – and I tell everyone that too!

2. Use website templates provided by your charity to send out messages. For larger charities that sponsor events (like Making Strides), the charitable organization generally has an event fundraising website where you can customize your page and send out emails requesting donations. Potential donors can then click a link to your page and donate via credit card. Easy – right? But I think the key is to share your personal story. People that visit my site know why I’m passionate about the cause, and they also get to see a picture of my hero and inspiration – my mom. I also customize emails that I send out through the site.

3. Start early and ask often. We’re all so busy and get so many emails, that sometimes we forget. I know I do! So, when I reach out to friends via email and ask for donations, I don’t stop at one request…or two, or three… I ask until they either remember to donate, or tell me to buzz off! Remember, people want to help, but they get busy. So, remind them! Very few people over the course of the last 16 years have told me to buzz off!

Why Donate?

So, why consider a donation today? Someone you know has heard or will hear the words “you have breast cancer”. Research funded by the American Cancer Society has helped find advanced treatment options and hope to ultimately find a cure. Money raised through these efforts goes to that research, and also directly to patient services. For more information about how to donate to my Making Strides campaign this year, click here. http://tinyurl.com/nx3cfgl

It’s easy to make a generous donation. You never know who you might be helping with a donation.

Thank you in advance!

Why Online Retailers Owe Their Tax Treatment to Mail Order Catalogs

Solely purchasing goods or services in person quickly became a thing of past almost 150 years ago thanks to the Montgomery Ward mail order catalog, which debuted in 1872. The Sears, Roebuck & Co. catalog followed in 1894, quickly becoming the premiere book from which the general public could purchase myriad products (I even remember buying “back to school” items from the Sears catalog when my family was stationed overseas). But did you know that these, as well as the Bloomingdale’s catalog that was created in 1896, paved the way for taxation of today’s online retailers? In her article Kelly Phillips walks us down a mail order catalog memory lane of sorts.

Mail Order Catalogs Paved the Way for Taxing Online Retailers

In the past and even still today, retailers that operated through mail-order systems such as catalogs or telephone ordering have not been required to collect and remit sales tax since merchandise was ordered through the mail and not at a brick and mortar store. If the mail order company did/does not have nexus in the state of the purchaser, collection of sales tax is not required. (By the way, it’s not a loop-hole, it’s the company’s Constitutional right.) However, in 1986, Bloomingdale’s By Mail catalog caught the attention of the Department of Revenue in Pennsylvania that wondered why the luxury retailer did not charge sales tax.

It’s no big surprise Bloomingdale’s argued that since items sold were from a catalog and not bought in-store in Pennsylvania, they did not need to collect taxes on products sold in By Mail. However, once the Dept. of Revenue realized that items ordered from By Mail could be returned to Bloomingdale’s stores in the state, the case went to court.

As the article discusses, Revenue argued in Bloomingdale’s By Mail v. Commissioner that By Mail was directly doing business in Pennsylvania for two reasons: The store advertised in the state and that the items for sale in By Mail were largely the same as those sold in its brick-and-mortar locations. Who won the case? Bloomingdale’s! Why? The court ruled that the retailer didn’t have a tax nexus in the state.

There have been several court cases, both at the state level and at the U.S. Supreme Court, that have focused on mail order catalogs. The most famous, arguably at the Federal level is Quill Corp v. North Dakota (1992). But its predecessor National Bellas Hess v Dept of Revenue in 1967 (also a Supreme Court case) largely framed the Court’s decision in Quill. So why do we still care? Because the internet is just like a big virtual catalog, and perhaps surprisingly, we’re talking about the same issues that we were over 50 years ago. Does the seller (catalog retailer, internet retailer) have nexus?

We’ve discussed tax nexus several times in previous blog posts. It basically means that states are required to establish a physical connection between taxpayers and the state before they can impose taxes. Of course, nexus is pretty easy to figure out for brick-and-mortar stores; they’re either in a state or their not. However, mail order catalogs (and, of course, the Internet) made nexus a bit harder to determine. Other things factored in as well, such as whether or not a retailer had a warehouse, call center or factory in the state.

Today, with billions of dollars of sales taking place on the Internet (that big mail order catalog in the cloud), online retailers like EBay and Amazon, as well as much smaller online retailers, are challenging states on nexus. Until there is some federal reform (such as the proposed Marketplace Fairness Act), the basic concept of nexus still applies, and companies are required to charge sales tax on items sold only into states where they have nexus.

While online retailers rein the shopping industry for consumers seeking the latest products at low prices, they truly do owe the way they tax their customers to their forerunners, mail order catalogs.

Photo Credit:Death to the Stock Photo

Focus on North Carolina

There are various explanations for the origination of the term “tar heel.” Perhaps the most convincing explanation is North Carolina’s early history of being a large exporter of tar. Regardless of the origin, the name has stuck and North Carolina is known as the Tar Heel State.

Business Climate:

North Carolina is the tenth most populated state in the country at an estimated 10 million in 2013. The city of Raleigh is considered one of the best places to work due to lower business costs than the national average and a highly educated workforce stemming from prominent universities such as UNC Chapel Hill, Duke University, North Carolina State University and many more. North Carolina is home to the Research Triangle Park, the largest research park in the country which has become a hot spot for technology and life science companies. In this area, there are over 190 companies with over 50,000 employees.

The state’s key industries include manufacturing, aerospace and aviation, defense, automotive, green energy, biotechnology, financial services, software and information technology. Charlotte, North Carolina is the second largest financial center, only behind New York City. According to the Charlotte Chamber, the total value of assets held by banks headquartered in the city is over $2.3 trillion in comparison to New York City’s $4.1 trillion and San Francisco’s $1.3 trillion. Its financial dominance is anchored by five of the top U.S. banks including Bank of America, the nation’s second largest bank.

Taxes:

Despite the state’s low cost of living and great weather climate, according to the 2014 State Business Tax Climate Index North Carolina ranks unfavorably at 44 out of 50. However, the Tax Simplification and Reduction Act enacted in July 2013 brought a brighter outlook for the state’s tax climate that should be beneficial in their rankings for years to come. Changes include a 5.8% flat rate on individual income tax, compared to a progressive tax rate as high as 7.75%. Other changes include a reduced corporate income tax rate (6.0% down from 6.9%) and a repeal of the estate tax. According to the Tax Foundation, in 2014 the combined state and local sales tax average was 6.9%, which ranks 25th nationally.Read more

Sales Tax & The 80/80 Rule

The world of taxation can be a confusing one. Tax codes are thick with rules and regulations that can be applied a number of different ways. A recent article in the Los Angeles Times underscores this idea. The article talked about the 80/80 rule and how it’s applied to sales tax. In this post we’ll take a look at the 80/80 rule and explain how it works.

Understanding the 80/80 Rule

The rule is a useful guide for figuring out if food sold to-go or as take out is taxable. Sales tax can be applied if more than 80% of a businesses’ revenue comes from selling food, and more than 80% of sales are from food eaten on the premises or is served hot.

The 80/80 Rule in Action

The rule seems pretty straightforward but, like most things in the tax world, there is nuance that complicates matters. Read more

Tesla Chooses Nevada

For the last several weeks, we’ve been blogging about tax incentives and the push of states to lure companies such as Tesla to build plants and employ workers in their state. Last week, Tesla announced that it will be locating its new factory to produce lithium ion battery packs (the so-called “Giga-factory”) in Nevada, just outside of Reno. Not Texas, Arizona, New Mexico, or the company’s headquarters state of California. The final tax incentive package reportedly offers the company tax breaks of over $1Billion including sales tax abatements over 20 years, real and personal property tax abatements over 10 years, payroll tax abatements, and even some transferrable tax credits (that the company can sell to other companies). While Tesla CEO Elon Musk claimed that the deal was done with Reno not solely for the tax incentives, they certainly had a huge impact on the decision.

As a Californian, I couldn’t decide if I was happy or sad to see the plant go to Nevada. Certainly, the obvious answer is that, as a citizen, I would have liked to see us retain or gain 6,500 jobs in the manufacturing sector. That would be good for everyone – right? But the state tax professional in me, and regular cynic of California politics is smiling a little bit deep inside that Tesla gave us the jilt. I want to say, “See, I told you so!” We watched as Governor Jerry Brown and our legislature did away with Redevelopment programs across the state in one fell swoop and then eliminated the successful enterprise zone program the following year – all in the name of somehow being friendlier to business in the Golden State. (Right? Help me with that math!) All of our tax rates are high (corporate, individual, and sales/use tax), we continue to have among the highest worker’s compensation rates in the country, and we make it difficult for companies to navigate our environmental laws to construct buildings – just to name a few things. While Mr. Musk didn’t specifically call out the state about these things, I can’t help but wonder if that didn’t have something to do with his decision to locate the factory outside of California. Tesla is the kind of company that gets things done. My guess is that trying to build such a Giga-factory here wasn’t going to “get done” quickly.

Don’t get me wrong. There are certainly a lot of things to love about California, which is why so many of us make this our home. But I think it is time for Sacramento to open its collective eyes and put its actions toward truly making this a better place to do business. If not, we’re likely to see some of our other gems leaving for other states. Not every deal will be a $Billion and promise 6,500 jobs, but small and mid-size companies can talk with their feet as well.