Texas & New Mexico and Sales Tax- SaaS, Software and More

Last month, we changed our format of our State of the Month posts by doing a “compare and contrast” between 2 states – California and Washington. This month, we continue our blog series with a contrast of a couple of southwest states – Texas and New Mexico – specifically their treatment of technology items for sales tax purposes.

Wait! Already know you need help with Texas or New Mexico issues? Please reach out to us at info@milesconsultinggroup.com

Software as a Service (SaaS) in Texas vs. SaaS in New Mexico

Software as a Service (SaaS) is subject to sales tax in several jurisdictions across the country. Approximately half of states (and some local jurisdictions) do tax the SaaS revenue stream. As you’ll see below, both states are aggressive regarding their treatment of sales tax.

California & Washington and Sales Tax- SaaS Software & other

If you’re a regular reader of our blogs, you know that we have, for the last few years, featured a different state of the month, and have profiled a number of things about that state. After running through the 50 states at least once, we thought we might try something a little different. We’d still like to feature our fabulous United States, but maybe do some compare and contrast in the areas that many of our readers and clients find to be the most useful. We look forward to your feedback.

This month, we contrast a couple of west coast states – California and Washington – specifically their treatment of technology items for sales tax purposes.

Wait! Already know you need help with California or Washington issues? Please reach out to us at info@milesconsultinggroup.com

Sales Tax and Due Diligence in an M&A Deal

The fast-paced world of private equity investment, mergers and acquisitions (M&A) and the art of aligning business interests in the perfect deal certainly sounds glamorous. It’s often where Wall Street meets Hollywood and depicts people reaping lots of money in the process! There are so many components in the making of a successful merger, including synergies between the companies’ cultures and employees, financial aspects, logistics, and other important areas. Tax matters (and in our world, state tax matters) are often the last pieces of the puzzle to be brought to the deal process. And while taxes are rarely the things making the headlines in a transaction, they really are an important piece of the overall transaction – both on the state income tax side (which we’ll discuss briefly below) and the sales tax side. And all the things that we discuss regularly here in our blog – nexus, taxability, look-back, exposure and remediation – they all come up in an M&A transaction. And if the exposure is big enough, it can derail a deal. Unfortunately, we’ve seen it happen!

Sales Tax, Software, SaaS & Consulting- How They Work Together

At Miles Consulting Group, we love software companies. They make up a significant part of our client base (both on-premise software and SaaS companies), our vendor base (of course we license it!), and even strategic partners. And yet, we recognize that sometimes, you just need a person to talk to. On the sales tax compliance side, that’s where we come in.

There are sales tax software companies out there (some of whom are our strategic partners, so this is where this fine line we walk gets a little curvy) who will tell companies how easy it is to “bolt on” their solution to billing or CRM systems. With the flip of a switch, sales tax compliance can be done monthly…if only the company knows where it has created nexus, knows exactly how to code its products, and has properly contemplated the ramifications of dealing with retroactive liability and also, possibly, income tax. We built a lot into that last sentence. Here’s why – it is never as easy as flipping a switch. We all know that, and yet, we realize how tempting it is for companies out there to want to jump to the “easy” software solution.

In this blog, we want to share some very common questions we get from clients and prospective clients, and share why the “people element” is still a necessary (and vital) element in the sales tax compliance equation. Let’s start with a few basic requests that we frequently encounter.

Can You Help us with Sales Tax Registrations in Multiple States?

Of course we can! But let’s ask a few questions first.

- Do you have nexus? Nexus can be of the physical presence type (employees or independent contractors, an office, or inventory within the state), or economic nexus (a certain threshold amount of sales – often referred to as Wayfair nexus in honor of the 2018 US Supreme Court case).

- If so, when did you create it?

- Many of the sales tax compliance software companies don’t talk much about retroactive exposure. Their sales people are focused on signing clients up for future software sales. We know, that sounds a bit cynical. But, we’ve had many conversations with clients who buy the software without really considering their potential retroactive exposure (more on that below).

- If you have created nexus some time ago (2020, 2021), are you prepared to deal with paying any tax which may have been due from those time periods? Have you considered voluntary disclosure agreements (see below)? Have you reached out to any customers to determine if they may have self-remitted the tax already, OR can you go back to customers to collect that back tax that you may not have collected? (Oh what a Pandora’s Box!)

- Have you considered the income tax ramifications of registering for sales tax? If you’ve created physical presence (and in some cases economic nexus), you might also have an income tax liability and filing requirement. S Corporations and LLCs have particular challenges with multistate filings because of their flow-through nature. Oftentimes, sales tax compliance software companies only consider the sales tax ramifications. We’ve seen clients be in difficult situations as a result.

In summary, with regard to registrations, our software colleagues may not always ask these questions. We do. It makes the overall compliance process much smoother to ask those questions up front.

Do We Need a VDAs?

Well, it depends. First let’s define what it is. A voluntary disclosure agreement (VDA) is essentially a legal contract between the state and the taxpayer, where both parties agree to certain stipulations as a premise of the taxpayer coming forward to pay retroactive taxes that are due, so that they can ultimately register in the state and begin to file prospectively. Generally, the state agrees to a limited lookback period (3-4 years) and will waive penalties. The taxpayer agrees (under penalty of perjury) to properly report and pay the taxes owed for those agreed upon periods.

There are multiple steps in the VDA process. Generally a taxpayer can remain anonymous for a period of time (and there are advantages to that), so it behooves a company to hire a third party to assist with the process. Also, companies like Miles Consulting have many years of experience in filing VDAs with various jurisdictions. Like so many things that we do with clients across the states – the process varies from state to state, and we know the nuances.

As with the registrations above, there are questions that we believe should be considered when contemplating going with VDA route.

-

-

- Should we just automatically do a VDA in all states?

- In our practice, we review all the facts of a client’s situation state by state, and if there is retroactive exposure, VDAs are certainly an option that we often recommend. But not all states are created equal, and not all situations are created equal. We take into account the amount of exposure, the level of retroactive documentation that a client may have (for instance with respect to exemptions, resales, etc.), whether or not a client’s customer may have self-assessed tax, and other items. These all play a part in our recommendation to file for a VDA or not. In our experience, oftentimes the software companies will push clients to file VDAs in many states before asking important questions, which can lead to over-selling modules and creating burden for the client.

- What about income tax?

- We have found that many software companies don’t ask the income tax questions. While companies are often eager to take care of the sales tax matters, we never recommend to handle them without considering all the ramifications. As such, we look at a client’s whole picture – not just sales tax – when recommending VDAs.

- Should we go through the Multistate Tax Commission (MTC)?

- The MTC is a coalition made up of state Departments of Revenue personnel (with input from the taxpayer community) that offers a VDA program under which taxpayers can file multiple VDAs in one place. In short, we rarely, if ever, recommend this approach, as it takes it out of the hands of our client and into an area where they relinquish a fair amount of control.

- Should we go through the Streamlined Sales Tax (SST)? – See above re: MTC…for all the same reasons!

- What about simply registering and back-filing needed returns?

- This is a very viable option for clients in states where estimated retroactive exposure is not as material. Under this scenario, a client might have either a shorter exposure window (say 18 months or less) or a smaller amount of exposure. While a state may not necessarily statutorily waive penalties under this approach, it may be more cost effective overall to take this approach. At Miles Consulting, we generally work with our clients on a combination of VDAs and registration and back-filing. Again, we help our clients to analyze the best course of action in each state. It’s not a cookie-cutter approach.

- Should we just automatically do a VDA in all states?

-

Sales Tax Compliance – What are the Options?

Obviously, gone are the days when people put pencil to paper, prepare a return and send it in! Right? Certainly, for the most part. There are still situations (for companies who have few filings and no multi-state exposure) where a company might essentially manually fill out a return on-line and monthly or quarterly file that way. But most of our clients are multi-state taxpayers and file in many states. As such, they really do need a software solution of some kind. And there are many good sales tax software providers out there. These companies have various modules that customers can purchase – often within a bundle – and pricing tends to be very aggressive. This is where the road we travel often becomes difficult to navigate. We KNOW there are good software and SaaS solutions out there. In fact, we, of course, also use software to assist our clients with compliance. However, it is our contention that the right solution is the one which incorporates both software and the human element of consulting. For all the reasons we’ve mentioned above, AND as it relates to the implementation of a sales tax software model, it’s just not as simple as buying a software solution. There are many things to consider, and it truly must include the human element.

-

-

- Is it Plug & Play?

- No. One of the biggest concerns for clients is that they really want to become compliant for sales tax – and soon. And in the process of trying to become complaint they often unwittingly purchase all the modules offered without really knowing the ramifications. This is because software companies aggressively price the bundled solution – but not everyone needs it all. Most important, a company must deal with retroactive exposure before registering and moving forward.

- Coding

- As part of the software integration process (so that that sales tax software can talk to the client’s ERP or billing system), the company will need to code its revenue products to talk to the software. Once this coding occurs, the sales tax software will then return, by state, the correct taxability of a particular product (like SaaS, hardware, or professional services, for example). However, the software providers don’t always share that up front. Customers buy the software, thinking it’s a one-stop solution only to find that they need to properly code their revenue items. Bottom line – we help with that. The software companies generally do not. Human element!

- Unusual products (for example - digital goods, mixed services, SaaS)

- What about properly coding a product that might have mixed use elements or not be clearly defined in the software company’s coding? We work with clients to really understand their revenue streams and help to perform proper coding – so that the correct amount of tax is charged on the front end. That is, the client collects and remits the correct amount from its customer. We often consult with clients on bundled items which might include some taxable components and some non-taxable components. This is a common area of concern for many companies. We help with that. Software companies? Not so much.

- Is it Plug & Play?

-

Software vs. Humans

As we prefaced at the beginning of the blog article, we truly do believe that a software solution for sales tax compliance is the right answer. However, we also believe that clients are better served when their implementation team includes the right mix of state tax consultants, software, and integration experts. Unfortunately, we sometimes find that the software companies try to be the “one stop shop” for those services. But, when the ultimate goal is to sell software, we believe there’s often a conflict to push companies to buy as much software as possible up front, when many times, the answer is more human interaction to analyze the best mix of consulting and software.

As the humans in the equation, we at Miles Consulting invite you to have a conversation with us to determine how we might help you evaluate your potential sales tax compliance situation. Contact us at info@milesconsultinggroup or 408-266-2259 to schedule your complimentary consultation.

Happy 21st Birthday Miles Consulting!

Every year as the calendar flips to March, I get a little nostalgic as I remember back to 2002, and the founding of the firm.

As many of you know, it’s a big step to quit a paying job and decide to hang out a shingle in the hopes of building that better mousetrap, taking control of your own destiny, and the lofty goal of making even the whole world a better place, one client or customer served, at a time. I decided to take that leap – along with a partner in spring of 2002. And I’ve never looked back in regret at that decision. I just look back to reflect, review and take some pride in what our business has become.

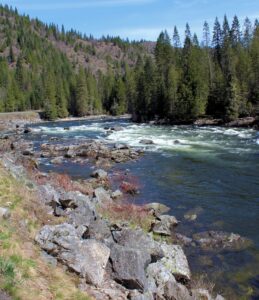

Focus on Idaho

This month we travel to the Pacific Northwest state of Idaho. Nicknamed, the gem state, Idaho is the 14th largest of the 50 states. It is known for it’s mountainous landscapes, vast areas of protected wilderness and outdoor recreation areas.

Forming part of the Pacific Northwest (and with the associated Cascadia Bioregion), Idaho is divided into several distinct geographic and climatic regions. The state’s north, relatively isolated Idaho Panhandle, is closely linked with Eastern Washington with which it shares the Pacific Time Zone- the rest of the state uses the Mountain Time Zone. The state’s south side includes the Snake River Plain which includes most of the population and agricultural land. The state is quite mountainous, containing part of the Rocky Mountains.

Business Climate

Idaho is an important agricultural state, producing nearly one-third of the potatoes in the United States. Additionally, all three varieties of wheat, dark northern spring, hard red, and soft white are grown in the state.

Why Economic Nexus Threshold Changes In South Dakota May Affect Your State

Close to five years ago, the landmark decision in the Supreme Court case of South Dakota v. Wayfair (2018) changed the sales tax landscape across the country. This decision made it so that states could require companies who met specific sales thresholds to collect and remit tax on sales, even if the company did not have a physical presence in the state. As of today, every state that has sales tax has enacted some sort of economic nexus law, but they have varying transaction threshold requirements, which makes it challenging for online sellers to keep up. As more states, including the state that started it all, jump on the bandwagon, could 2023 be the year transaction thresholds are done away with altogether?

What Are The Challenges Of Current Economic Nexus Threshold Requirements?

There are currently six broad categories of economic nexus thresholds, including:

- $100,000 (17 states)

- $100,000 or 200 transactions (23 states, Puerto Rico and the District of Columbia)

- $100,000 and 100 transactions (one state)

- $250,000 (two states)

- $500,000 (two states)

- $500,000 and 100 transactions (one state)

However, this isn't where the differences between state economic nexus thresholds end. Some states' thresholds only include taxable sales of tangible personal property (TPP), while others are based on gross sales. Some state thresholds include services, but they aren't counted in others. If you sell through a marketplace, that adds another layer of complexity - some thresholds include sales made through a marketplace, but some do not.

If that wasn't challenging enough for businesses, states also base thresholds on different time periods. In some states, it is the prior or current calendar year that matters. For others, only the prior calendar year, the past 12 months or the past four calendar quarters are taken into account. Some states have a different time requirement entirely. You can see why business owners and sales tax experts have called for uniformity.

What States Have Already Eliminated An Economic Nexus Transaction Threshold Requirement?

One way many states are already simplifying sales tax nexus laws for businesses is by removing the transaction threshold requirement. The transaction threshold has been particularly challenging for small businesses that may not make much in terms of sales but have met the 200-transaction threshold and therefore have nexus in states with that requirement. With the elimination of the transaction threshold, businesses have greater certainty and clarity in evaluating their sales tax nexus footprint.

Thirteen states never had an economic nexus transaction threshold to begin with - Alabama, Arizona, Florida, Idaho, Kansas, Mississippi, Missouri, New Mexico, Oklahoma, Pennsylvania, South Carolina, Tennessee and Texas. Eight states have eliminated their preexisting nexus transaction thresholds, including our home state of California. Some other states that have followed suit are Colorado, Iowa, Maine, Massachusetts, North Dakota, Washington and Wisconsin.

South Dakota, the state that led the charge to tax remote sales, just joined the growing trend to remove the transaction threshold with the signing of Senate Bill 30 by the governor on February 9, 2023. Up until now, the threshold requirements in South Dakota were $100,000 in gross sales or at least 200 separate transactions in the current or previous calendar year. The change will take effect on July 1, 2023.

Is Further Economic Nexus Simplification On The Horizon?

We hope so! The Senate Finance Committee met in June 2022 to discuss and hear testimony from sales tax experts to see what can be done to make compliance easier for businesses and economic nexus and Wayfair streamlining was a large topic of discussion. While we can't exactly predict what the future holds for economic nexus and sales tax law, experts agree that a simplified and more uniform process would ease the compliance burden, especially for small businesses that may not have as many resources. As updates come, we will continue to keep you informed on our weekly blog. If you need further support, our expert sales tax team at Miles Consulting Group is happy to help!

Do You Need Help Keeping Up With Economic Nexus Threshold Requirements?

If you find yourself with economic nexus transaction requirements in the states where you do business or need overall sales tax support, we have a skilled multistate tax team who would love to work with you and take that pressure off your back! We are happy to meet with you and clarify any tax issues you are trying to navigate. Contact us today.

Important Updates Marketplace Facilitators Need To About New INFORM Consumers Act

Following the 2018 South Dakota vs. Wayfair U.S. Supreme Court decision that eliminated the physical presence standard for sales tax nexus, not only have most states enacted economic nexus legislation, but many have also started requiring marketplace facilitators to collect and remit sales tax on behalf of the third party sellers.

A marketplace facilitator (or MPF) is a business or organization that contracts with third parties ("sellers") to sell goods or services on its platform, facilitating the sales that arise (large examples include Amazon or Etsy). These companies facilitate sales of goods or services between a seller and a buyer - but generally, the MPF does not take title to or even carry the inventory.

Because of the complexity that can arise for these marketplaces, we often share articles detailing the most up-to-date marketplace facilitator laws. You can read some of our past articles here and here. Today, we share what the new INFORM Consumers Act means for marketplace facilitators.

What Is The INFORM Consumers Act?

The INFORM Consumers Act, which was signed into law on December 29, 2022, is designed to reduce and ideally eliminate counterfeit sales. It was signed into law as a last-minute addition to the Consolidated Appropriations Act of 2023, a bill that authorizes federal government spending for the upcoming year. The consumers act applies to online marketplaces and requires them to collect, verify and make available to buyers certain identification information for 'high-volume third-party sellers' on their platform (sellers with more than 200 transactions and $5,000 in revenue in a 12-month period). The Consumers Act requirements go into effect on June 27, 2023.

What Do Online Marketplaces Need To Implement To Comply With The INFORM Consumers Act?

Online marketplaces must implement policies, procedures and controls to comply with the following new requirements:

- Collect and verify information from high-volume sellers at least once a year, including:

- Bank account number or name of the payee (if no bank account number).

- Contact information.

- Seller is a business? Copy of a valid, government-issued record or tax document with the business name and physical address.

- Seller is an individual? Name of the individual.

- An individual acting on behalf of an individual seller? Copy of valid government-issued identification for the individual.

- Business tax identification number or taxpayer identification number.

- Email address and phone number of the seller.

- Disclose certain high-volume sellers (sellers with an aggregate total of $20,000 or more in annual gross revenues on the marketplace) information to buyers, including:

- Seller's full name, physical address and contact information to consumers either on the product listing page or another consumer communication.

- Identify whether the seller used a different seller to supply the product to the consumer upon purchase.

- There is a listed exception for high-volume marketplace sellers working out of their residences. These sellers must provide the country and state where they reside, but don't need to provide the specific street address. The marketplace needs to let consumers know there is no business address and provide a way for consumers to contact the seller.

- Provide clear and conspicuous consumer reporting options on high-volume seller pages.

- Comply with data privacy and security requirements.

What Are The Consequences Of Non-Compliance For Marketplace Facilitators And High-Volume Sellers?

If a high-volume seller does not comply with these new requirements, the online marketplace can suspend sales activity on their account. The marketplace needs to alert the seller with written or electronic notice and give the seller 10 days to comply. If the marketplace fails to enforce the INFORM Consumers Act, they are subject to civil or criminal penalties, which could exceed $46,000 per violation. While some online marketplaces may already comply with some of these requirements, many will likely need to implement new measures, so we recommend reaching out to a team of sales tax professionals, like our team at Miles Consulting, to ensure you are ready in June.

Do You Need Help Keeping Up With Marketplace Facilitator Laws?

If you find yourself with questions regarding marketplace facilitation under the INFORM Consumers Act, or sales tax in general, please give our team of multistate tax experts a call! We would be happy to help you and clarify any tax issues you are trying to navigate. Contact us today.

Does Your Business Need A Nexus Study? Everything You Should Know Now

These days, most companies conduct business across state lines. Even if you think you are compliant, there may be taxes and fees you are unaware of. A nexus study may be the best step for your organization to take to ensure you are meeting all of your sales tax liabilities. Keep reading to learn what a nexus study is, if your organization needs one and how Miles Consulting Group can help.

What Is A Nexus Study?

Let's first clarify what nexus is. Sales tax nexus occurs when your company has some sort of connection to a state that has a sales tax. Although 45 states and the District of Columbia have a state level sales tax, the laws that create sales tax nexus can vary slightly state by state. Overall, most states agree that a physical or economic presence creates nexus. (And just to avoid confusion, we also address nexus as it pertains to income tax - but for purposes of this blog, we are focused on sales tax.)

What are ways that a business can create nexus in a state? Below are examples of physical presence creating nexus.

- Having an office in a state

- Having an employee, salesperson, contractor, etc. in a state

- Owning a warehouse or storage facility in a state

- Storing inventory in a state (such as in an Amazon FBA warehouse or other 3rd party fulfillment center)

- Temporarily doing physical business in a state for a limited amount of time, such as at a trade show or craft fair

And, of course, as we've written about frequently, economic nexus is created by crossing certain sales thresholds - either dollar or number of sales.

Now that you know how nexus is created in multiple states, what is a nexus study?

A nexus study is a process to analyze and review all your business activities and sales in a state (or states) to determine if (and very importantly, when) they create sales tax nexus. A nexus study is often the first step to becoming sales tax compliant since it tells you where you have sales tax obligations, and when they started and can help determine what next steps need to be taken. We often describe it to our clients as taking a snapshot of your sales tax situation at a moment in time to determine a.) if you have created nexus in the past and therefore have a retroactive filing responsibility (and more importantly, sales tax obligation) in a state, b.) what the dollar amount of that retroactive exposure is (along with potential interest and penalties), a remediation plan and a plan for going forward.

What Are The Benefits Of Doing A Nexus Study?

We have conversations daily with potential clients who aren't fully compliant with sales tax, but really do want to become compliant. And the conversation often starts with "Can I just register for sales tax and start collecting and filing going forward?" Well …. no. States want to know (on the registration documentation, that a company representative files under penalty of perjury) when nexus was first created. If it was, say, three years ago, the state would require the company to pay that tax. Many companies are not aware of that, nor in a position to pay those back taxes.

A nexus study can help to determine that snapshot of potential exposure, so that you can properly analyze the situation (along with your favorite state tax consultant) and what the best next steps are toward full compliance. If you think you may have a sales tax problem, a nexus study is a way to effectively diagnose the problem, and for that matter, a possible income tax problem as well.

A nexus study can also be beneficial if you believe you have been fully compliant but need some clarity on your obligations going forward. It can help determine if you no longer need to file in certain states that you needed to in the past.

Another area where a nexus study is beneficial is before a merger or other transaction. The buyer company will always engage in due diligence to determine whether there are outstanding sales tax liabilities. Potential targets (or sellers) can do themselves a huge service by having those questions answered for themselves before a third party reviews that situation in the heat of an M&A transaction.

How Can Miles Consulting Group Help?

We tailor each nexus project to the specific client to ensure needs are being met. Here are some of the questions we may ask you as part of your review:

- Do you have physical presence nexus?

- Do you have economic nexus?

- Is your product or service taxable?

- Are there any available exemptions (e.g. food or medical exemptions, sales to qualified nonprofit entities)?

- Do you need to start collecting and remitting sales and use tax?

- You've collected tax from a given state and have not remitted it - what now?

- You're a target in an M&A deal? Let's confirm whether a buyer would find any skeletons in the closet!

Once you have completed a nexus study and established where you have liabilities, what are the next steps?

After we determine your liabilities, Miles Consulting Group can continue to support you through your compliance journey. When we determine possible exposure, we help clients receive maximum benefit from available amnesty programs, contract for voluntary disclosure agreements or simply document their exposure if that is all that is needed at that point.

Please contact us today if you have any questions or are interested in moving forward with a nexus study.

A Simple Step-By-Step Guide To Stay Ahead Of Sales Tax Compliance

Sales tax compliance can be overwhelming, and it's even more complicated if you, as the seller, have an economic presence in multiple states because of the number of things to keep track of. This step-by-step sales tax guide is a useful place to start to ensure you stay ahead of your filing requirements. We always try to remind clients that sales tax is a pass-thru fiduciary tax. If you collect it and remit it correctly, there should be no liability to the seller. Where it gets dicey is when the seller doesn't correctly collect, remit and report in jurisdictions in which it is required to do so.

1.) Discover Which States You Meet The Physical Or Economic Nexus Threshold In

The first step is to determine where your business may be liable to collect sales tax. Before 2018, this was more straightforward. If you had a physical presence in a state, you were responsible to collect and remit sales tax. The 2018 U.S. Supreme Court ruling in South Dakota v. Wayfair, Inc changed the sales tax landscape by allowing South Dakota to enact economic nexus legislation, meaning that sellers who had a certain amount of economic presence in the state (either by reaching a certain number of sales or amount of money from sales) were also liable to become compliant in that state, even without a physical presence. Other states quickly jumped on the bandwagon, and today every state has some level of economic nexus legislation. Economic nexus threshold requirements vary by state, so check out yours here. It's important to note that the enactment dates for economic nexus measurement also differ from state to state, so there are several moving parts in correctly determining the nexus start date. Sellers now need to consider BOTH their physical presence and economic nexus in a state to determine the correct reporting date.

2.) Determine If Your Products And Services Are Subject To Sales Tax

Now that you know which states you have reached nexus in, it is time to figure out which products and services are subject to sales tax and the state sales tax rates. Heads up - this varies greatly by state, and in some states it can even vary by city or county. In general, the sale of Tangible Personal Property (TPP) is subject to sales tax collection in the United States, but there are plenty of exemptions. And it's not always clear what TPP is. What about software? Software as a service (SaaS)? Other digital products?

On the other hand, traditionally services are generally not subject to sales tax unless specifically delineated. However states are becoming more aggressive and also expanding definitions of services that might fall under their taxable enumerated services. (An example includes data processing services - taxable in many states.) Make sure you are up to date here as well. Other things that can create nexus and state tax reporting issues include:

- Hiring a new employee

- Contracting with an independent contractor

- Maintaining inventory in third-party warehouses

- Owning property or renting office space

- Being a lessor of items of property (such as sensors, widgets, etc.) that your customer may use in a state, but where you retain title and charge a lease or rental charge

- Using fulfillment services like Fulfillment By Amazon (FBA) or similar services which place inventory in third-party warehouses in different states

3.) Register, Report And File To Meet Sales Tax Due Dates

Once nexus and taxability have been addressed, it's generally time to register for a sales tax permit in each of the states in which you are subject to sales tax collection. This process also varies by state, so check out this helpful guide from TaxJar to learn how to register. Important planning note: Depending upon the nexus start dates determined, a seller may find that they have retroactive exposure because they should have been collecting and remitting tax in a state for several years prior. Remember earlier, when we said there should be no liability for the seller, since sales tax is a pass through? Well, if sales tax hasn't been correctly collected in prior periods, then the liability may shift to the seller. This is where we assist clients regularly. We will often work with them to become compliant for prior periods (either through the voluntary disclosure process or via registration and back filings). Only once the retroactive remediation is done can a company properly file correctly going forward.

Once a sales tax due date comes around, you will need to prepare for filing by determining the amount of sales tax you collected in the state and in each county, city and/or other special taxing district. Then it is time to file.

4.) Filing - Consider Automation

We've been doing state tax consulting for long enough to remember paper filings … but we certainly don't recommend going that route anymore! There are a lot of software options out there for companies when it comes to sales tax compliance. We work with our clients and recommend many of the popular software vendors out there, depending on each client's unique situation. We always recommend a balance of consulting (generally to properly determine nexus, taxability and any retroactive remediation, as discussed above), combined with an automated solution for filing going forward. And in that process, communication is key. That's one of our strengths! Along with those many years of experience!

5.) Still Have Sales Tax Compliance Questions?

As shown above, it is usually not as easy as 1,2,3 or "plug and play" of a software product - especially if you weren't sales tax compliant in the past. Luckily, our team of multistate sales tax experts can help support you and move forward with tax compliance. Please contact us today. We're happy to clarify any multistate sales tax issues you're trying to navigate.