MULTI-STATE SALES TAX INDUSTRY EXPERTISE

Miles Consulting provides expertise and proven processes to assist clients with the complications of state sales tax and income tax. We deliver both top-level summaries and detailed analysis in clear language so our clients can do what they are paid to do: grow their businesses and maximize shareholder value.

From our office in the heart of Silicon Valley, Miles Consulting offers multi-state sales tax insight and other financial guidance for clients nationwide across a large variety of industries:

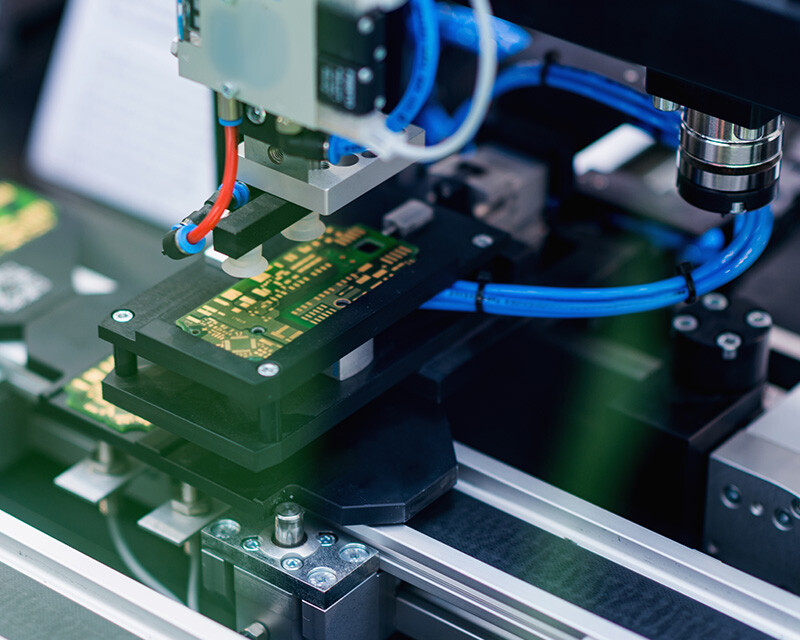

Technology

We are proud to work with clients in various technology sectors, including software, cloud-based (SaaS), biotech, telecom and networking. Businesses in this field benefit greatly from these services:

- Nexus reviews (multi-state income, franchise, and sales/use taxes)

- Taxability studies

- Voluntary disclosure (for tax remediation)

- Sales tax compliance

- Audit assistance

- Navigating e-commerce rules

- Due diligence analysis in purchase transactions

- Reviews of tax credits

Many of our technology clients are start-ups and can’t afford a “50 state study” — often they don’t need one, either! We tailor each project to provide the answers that our clients need to know today — for filing, financial reporting and peace of mind — as they expand.

Our technology clients have ranged from the Fortune 10 to small-cap businesses and everything in between. Oftentimes, our multi-state tax projects include those where the client has a need, but not enough staff, or they involve assignments requiring specialized state tax knowledge that may not exist in-house. Miles Consulting is capable of working with virtually all functions inside a business in order to facilitate completion of the project; we are also available to train in-house staff.

Manufacturing & B2B Sales

For businesses in the manufacturing and B2B industries, it’s especially important to understand how current and pending legislation may affect sales tax, income tax, tax credits, and other state and local taxes your company may be responsible for and/or able to take advantage of. We can help by offering these services:

- Sales tax consulting

- Sales tax “reverse audits”

- Income tax consulting

- Tax credit reviews

- Resale and exemption certificate reviews/consulting

Retailers (Online or Brick & Mortar)

Miles Consulting helps retailers understand and navigate the rules related to online sales tax. With the U.S. Supreme Court’s decision in South Dakota v. Wayfair, states have enacted economic nexus statutes. And, as usual, the states are not uniform in their enactment dates, thresholds (sales levels and number of transactions) and filing requirements.

We work with our clients to help determine nexus and taxability with respect to their activities and products/services. We keep them abreast of necessary and proposed changes to online retail rules, as well as the nuances of retail and sales tax issues in general, including:

- Tracking and managing economic nexus thresholds

- The taxability of drop shipments

- The maintenance of exemption certificates and resale certificates

- Deciding on a compliance system

- The impact of online marketplaces

Construction

The construction industry has unique rules when it comes to the sales tax ramifications of purchasing materials and resale of those materials. We regularly assist California (and multi-state) construction companies in reviewing contracts, and correctly classifying purchases and resales.

Our construction clients include both regional and national companies, as well as light and heavy construction.

Other Industries

Miles Consulting assists clients in a wide variety of other industries too, such as:

- Shipping

- Assembly

- Public utilities

- Professional services firms

Our services range from multi-state income and sales/use tax analysis to tax credits, and are sometimes performed for affiliated professional services firms as a service to their clients.