Benefits of Outsourcing Sales Tax Compliance

Keeping Up With Sales Tax Compliance: A Guide to Outsourcing for Businesses

Sales tax compliance is a crucial but complex aspect of running a business in the United States. But it’s tax, and so it comes with constantly evolving regulations and varying rules across states that make it a daunting task for many businesses. However, there is a solution that can help you navigate these complexities efficiently: outsourcing sales tax compliance. Let’s talk about that here – we have some practical insights into the benefits of outsourcing and how to choose the right partner for your business.

Understanding Sales Tax Compliance

Sales tax compliance involves adhering to state and local regulations regarding the collection and remittance of sales tax on goods and services. Ensuring compliance is vital to avoid penalties and maintain good standing with tax authorities. However, managing sales tax is challenging due to the varied tax rates, ever-changing laws, and the need for precise record-keeping. Many businesses struggle with these challenges, which can divert valuable resources away from core operations. And that’s when outsourcing becomes a highly practical option.

But what is outsourcing? Let’s unpack the concept here – this is what we’ll cover:

- What is Sales Tax Outsourcing?

- Definition and process of outsourcing sales tax compliance.

- Benefits of Outsourcing Sales Tax Compliance

- Time Savings

- Accuracy and Compliance

- Cost Efficiency

- Access to Expertise

- Scalability

- Technology and Tools

- A Real-World Example

- Case study highlighting the importance of human oversight in sales tax compliance.

- Selecting the Right Outsourcing Partner

- Criteria for choosing an effective sales tax outsourcing provider.

Not what you’re looking for? Let’s talk. Reach out to us at info@milesconsultinggroup.com.

1. What is Sales Tax Outsourcing?

Sales tax outsourcing involves delegating the responsibility of managing sales tax compliance to a specialized third-party provider. This process includes tasks such as registering for sales tax permits, collecting and remitting taxes, and maintaining accurate records, including resale and other exemption certificates. By outsourcing, businesses can leverage the expertise of professionals who are well-versed in tax laws and equipped with advanced tools to ensure compliance. This approach not only simplifies tax management but also provides peace of mind.

2. Benefits of Outsourcing Sales Tax Compliance

Time Savings

Outsourcing sales tax compliance allows businesses to focus on their core activities. By entrusting tax responsibilities to experts, you free up valuable time that can be invested in growth and innovation.

Accuracy and Compliance

Outsourcing your tax functions offers significant advantages in terms of accuracy and compliance. Professional service providers specialize in ensuring that your tax filings are precise and submitted on time, effectively minimizing the risk of errors and avoiding costly penalties. Unlike automated software solutions that often promise a "set it and forget it" approach, human expertise plays a critical role in reviewing nexus, accurately coding revenue items, and offering comprehensive audit support. This human oversight helps to identify and address complexities that software alone might overlook, providing an additional layer of security and peace of mind for your business.

Cost Efficiency

Outsourcing can be more cost-effective than maintaining an in-house tax team. It reduces the need for specialized tax expertise and helps avoid penalties and interest from incorrect filings.

Access to Expertise

Tax professionals bring specialized knowledge and skills that are crucial for maintaining compliance with evolving regulations. Their expertise ensures that your business navigates even the most complex tax scenarios effectively. For instance, at Miles Consulting Group, we excel at determining the optimal timing for starting to collect sales tax, providing guidance on retroactive remediation, and accurately coding revenue items within tax software. Our team’s deep understanding of tax nuances helps ensure that your business remains compliant and well-positioned to handle any tax-related challenges.

Scalability

Outsourcing allows your tax compliance efforts to scale with your business. As your operations grow and tax regulations change, your outsourcing partner can adapt accordingly.

Technology and Tools

Outsourcing providers use advanced tax software and tools to streamline compliance processes. These technologies enhance accuracy and efficiency, reducing the administrative burden on your business. However, the human touch is necessary to ensure these tools are used correctly and effectively. And with Miles Consulting as your partner, you get the tech and tools, along with the human expertise to leverage them right. It’s a win-win!

3. A Real-World Example

As we said, managing sales tax compliance can be a complex and challenging task for many businesses. One significant problem that companies often face is the incorrect coding of taxable services, which can lead to substantial financial penalties during audits. Again, the human touch that comes with an outsourced partnership can provide the level of insight that saves businesses money, in complex tax matters such as these.

And we’ve seen it before:

A client of ours decided to streamline their sales tax processes by investing in a sophisticated software program. This software promised to handle the complex task of collecting and remitting sales tax for the company’s various revenue streams. The client’s business was diverse, involving revenue from a SaaS product, electronically downloaded software, consulting services related to the software, and training sessions.

Eager to get things right, the client meticulously coded each item within the sales tax software. They carefully matched their sales categories to the line items suggested by the software’s extensive list of options. However, when it came to coding their consulting services, they faced a challenge. With hundreds of "consulting SKUs" available, they selected one that seemed appropriate but didn’t explicitly indicate whether consulting on software implementation was taxable in a given state.

Months turned into years, and everything seemed to be running smoothly—until the day of the audit arrived. The state auditor reviewed the client’s records and found that the consulting services, which the software had categorized incorrectly, were indeed taxable in the state. This misclassification led to a hefty tax bill, totaling several hundred thousand dollars, plus interest.

The client’s investment in the software hadn’t shielded them from the consequences of incorrect coding. The audit revealed that despite their best efforts, the software's recommendations and the client's chosen codes had resulted in significant tax exposure. It served as a stark reminder that even advanced tools need careful human supervision and handling, in order to avoid costly mistakes.

4. Selecting the Right Outsourcing Partner

Choosing the right sales tax outsourcing provider is critical to avoiding those kinds of nasty surprises. Ask potential providers about their track record with businesses similar to yours and their approach to staying updated with tax law changes. Evaluate their technological infrastructure and how it integrates with your existing systems to ensure seamless data flow and accurate reporting. Additionally, consider the level of customer support they offer—having access to knowledgeable support staff can make a significant difference in resolving issues promptly. It’s essential to select a partner who understands your specific needs and can offer tailored solutions for your business, ensuring compliance and minimizing the risk of costly errors.

At Miles Consulting Group, this is what we do. Book a consultation, drop us a line, or send us an email at info@milesconsultinggroup.com.

Outsourcing sales tax compliance provides numerous benefits, including time savings, cost efficiency, and enhanced accuracy through access to expertise. By delegating these responsibilities, businesses can streamline their operations and focus on growth. Our services offer comprehensive solutions to meet your needs:

- Full compliance management

- Proper coding of revenue sources to the correct software codes

- Assistance in selecting the right software provider

- Managed services to collaborate with your internal team and software provider for reviewing and reconciling monthly or quarterly returns.

Engage us for any or all of these services to ensure your sales tax compliance is handled efficiently and effectively.

Vermont is the Latest State to Administer the Taxability of SaaS

If you’re a frequent reader of our blogs, you know that we regularly report on the taxability of Software-as-a service (SaaS). Today, we report that Vermont has joined the ranks of states that do require sales tax collection on revenue from SaaS. In a recently updated previous blog (What To Know About The Taxability Of SaaS In 18 Key States - Multi State Tax Solutions | Miles Consulting Group), we discuss where SaaS is taxable in 20 states (and also certain local jurisdictions). As of July 1, 2024, we can now add Vermont to that list of taxable states.

Effective July 1, 2024, a new law in Vermont repeals its sales and use tax exemption on prewritten computer software accessed remotely (i.e., cloud software), thus subjecting items like software as a service to Vermont’s sales and use tax rate of 6%.

The amendment reads that “Tangible Personal Property” means personal property that may be seen, weighed, measured, felt, touched, or in any other manner perceived by the senses. “Tangible personal property” includes electricity, water, gas, steam, and prewritten computer software regardless of the method in which the prewritten computer software is paid for, delivered, or accessed.

If your company is doing business in Vermont and is selling the SaaS product in Vermont too, Miles Consulting Group can assist with any questions that you may have.

Book a consultation, drop us a line, or send us an email at info@milesconsultinggroup.com.

Navigating Nexus: Strategic Decisions to Minimize Tax Exposure

So, your business is expanding, and you now have touchpoints in multiple states. That’s great! Remember, though, that with that growth, the ever-watchful eye of state taxing authorities often becomes more intense. As sales channels expand and interstate commerce becomes more prevalent, staying compliant with sales tax regulations across multiple jurisdictions gets trickier. Central to this challenge is the concept of economic nexus, a critical factor that determines a business's obligation to collect and remit sales tax in various states. (For those of you who have been tracking the history of “economic nexus”, note that we just passed the 6-year anniversary of the US Supreme Court’s ruling in South Dakota v. Wayfair (June 2018) – the inflection point for all states to ultimately jump on board and enact nexus rules based on sales volume rather than physical presence. For more on how the Wayfair decision has impacted small and mid-sized business, read this blog we wrote).

This can all seem a little scary – but it doesn’t have to be, and you certainly don’t have to go at it alone.

This article aims to guide businesses through strategic decisions to minimize tax exposure, helping them navigate the intricate landscape of sales tax nexus. Remember, doing it right is essential to avoid making sales tax your liability.

Here’s what you can find out.

- Understanding Sales Tax Liability

-

- Definition and Importance: Learn about sales tax liability and its impact on compliance and business operations.

- Types of Sales Tax Liabilities: Distinguish between current and noncurrent sales tax liabilities.

- Consequences of Noncompliance: Understand penalties, interest charges, and legal issues from noncompliance.

- Calculating Sales Tax Liability

-

- Steps to Calculate Sales Tax Liability: Follow a step-by-step guide to accurately determine sales tax owed.

- Pre-payment Requirements: Know state-specific pre-payment requirements and their impact on cash flow.

- Strategic Decisions in Sales Tax Management

-

- Key Strategies to Optimize Sales Tax Nexus Implications: Explore strategies to manage physical presence, economic thresholds, and exemptions.

- Leveraging Sales Tax Incentives

-

- Types of Sales Tax Incentives: Identify various incentives like enterprise zones, manufacturing exemptions, and R&D credits.

Not what you’re looking for? Let’s talk. Reach out to us at info@milesconsultinggroup.com.

1. Understanding Sales Tax Liability

Sales tax liability refers to the obligation of a business to collect and remit sales tax on transactions within states where it has established nexus. Nexus, in simple terms, is the connection between a business and a state that triggers the responsibility for sales tax collection. This liability affects both online and brick-and-mortar businesses, necessitating a thorough understanding of the factors that establish nexus. For more on those factors, and nexus in general, read this article we wrote.

It's important to distinguish between current and noncurrent sales tax liabilities. Current sales tax liabilities are taxes collected from recent transactions that a business must remit to the state within a specific period. These are generally straightforward since the sales tax is a pass-through cost that the business collects from the customer and passes on to the state. However, noncurrent sales tax liabilities refer to past due taxes that have not been remitted on time. These can become out-of-pocket expenses for businesses if they did not collect the sales tax from customers when required. Noncompliance with sales tax obligations can lead to penalties, interest charges, and legal complications, making it essential for businesses to stay current with their sales tax filings.

2. Calculating Sales Tax Liability

Accurately calculating sales tax liability is vital for compliance and financial planning. Here’s a step-by-step guide to help businesses calculate their monthly and annual sales tax liabilities:

- Identify Nexus States: Determine the states where your business has nexus based on physical presence, economic activity, or other criteria set by each state.

- Understand Tax Rates: Research the sales tax rates applicable in each nexus state, including state, county, and municipal rates, as these can vary significantly.

- Track Taxable Sales: Maintain detailed records of all taxable sales in each state. This includes online and in-store transactions, ensuring that all sales data is accurate and up-to-date.

- Apply Tax Rates: Multiply the taxable sales amount by the applicable tax rate in each state to calculate the sales tax owed.

- Utilize Tools: Use sales tax calculation tools and software to automate the process. Tools like Avalara, TaxJar, and others can help ensure accuracy and simplify the calculation process.

- Review and Remit: Regularly review your sales tax calculations to catch any discrepancies. Ensure timely remittance to avoid penalties.

It's also worth noting that some states, such as California and New York, require pre-payments of sales tax. Businesses must make these pre-payments in the first and second months of each quarter, with the amounts credited when preparing the quarterly return. This system allows states to receive revenue faster and requires businesses to manage cash flow carefully.

Which states require accelerated sales tax payments?

Here are a few of the larger states requiring prepayments, as outlined by Avalara on their ‘Prepayments’ page. Note that other states may require prepayments as well. We include these states as examples.

California

Determination Period Range: This is subject to state review. If you're uncertain about the determination period for a client, contact the CDTFA.

Requirement Threshold: The average monthly taxable sales must be $17,000 or more.

Frequency: Inverse quarterly.

Due Date: 24th of the month.

State-Approved Calculation Methods: For information on state-approved calculations, refer to the CDTFA website. The calculation method varies depending on the period for which the prepayment is due.

Supported Calculation Methods: 100% of monthly liability.

Reporting Format: Payments are made via the CDTFA website. Prepayments made through the prepayment filing calendar will appear as prior payments on the CA CDTFA 401 A2 or CA CDTFA 401 A2 Outlet return.

Set-Up Instructions: Add the CA Prepayment filing calendar. The default prepayment percentage is set to 100%, meaning the prepayment is calculated as 100% of the current period liability. If a different calculation method is needed, edit the filing calendar and enter a different prepayment percentage:

- Enter 90% to meet the state's minimum requirement.

- If a full year of transaction data hasn't been imported, calculate the prepayment amount outside the usual system and enter the amount as a prepayment adjustment.

Filing Method: Manual web file.

Additional Information: For the prepayment period from May 1 through June 15, due on June 24th, a different calculation method is required. This calculation is not automated, so you'll need to manually adjust the prepayment amount when preparing the prepayment filing calendar for that month.

Florida

Determination Period Range: July to June.

Requirement Threshold: If you paid $200,000 or more in state sales and use tax on returns filed during the most recent state fiscal year (July 1 through June 30), you must make an estimated sales tax payment every month, starting with the December return, due January 1.

Frequency: Monthly.

Due Date: 20th of the month.

State-Approved Calculation Methods:

- Average Tax Liability: 60% of the average monthly sales tax amount during the previous calendar year (beginning on the December tax return due in January).

- Current Month of Previous Year Tax Liability: 60% of the tax liability from the same month in the previous year.

- Current Month Liability: 60% of the tax liability that will be due with the next return.

Supported Calculation Methods:

- 60% of the average monthly sales tax amount during the previous calendar year.

- 60% current month prior year liability.

- Fixed amount.

Reporting Format: Prepayments and prior payments are reported on the FL DR15 and FL DR15CS returns.

Set-Up Instructions: Add the FL DR15 or FL DR15CS filing calendar. The default prepayment percentage is 60%, which means that the prepayment is calculated as 60% of the prior calendar year average liability. If a different calculation method is needed, edit the filing calendar:

- Enter a prepayment percentage of 60% to calculate the prepayment as 60% of the current month from the prior year.

- Enter a fixed dollar amount.

If a full year of transaction data hasn't been imported, calculate the prepayment amount outside the usual system and enter the amount as a prepayment adjustment.

Filing Method: File electronically.

New York

Inverse Quarterly

Use this prepayment method if the client files the NY ST810 quarterly return and meets the requirement threshold.

Determination Period Range: June to May.

Requirement Threshold: Liability of $300,000 or more in a quarter.

Frequency: Inverse quarterly.

Due Date: By the 20th of the month.

State-Approved Calculation Methods: 100% of monthly liability.

Reporting Format: Payment is made via the NY ST809 filing calendar. Prepayment amounts remitted through this filing calendar flow to the NY ST810 quarterly return as a prior payments credit.

Set-Up Instructions: Add the NY ST809 filing calendar. The default prepayment percentage is 100%, meaning the prepayment is calculated as 100% of the current month's liability.

If a full year of transaction data hasn't been imported, calculate the prepayment amount externally and enter the amount as a prepayment adjustment.

Filing Method: Manual web file.

Determination Period Range: June to May.

Requirement Threshold: Liability exceeding $500,000 between June 1 and May 31.

Frequency: Monthly (refer to the NY Department of Taxation and Finance website for payment periods).

Due Date: Three business days after the 22nd.

State-Approved Calculation Methods:

- Actual Method: Payment must be at least 90% of the actual sales and use tax liability for days 1 through 22 of the current month.

- Estimated Method: Payment must be at least 75% of one-third of the liability for the comparable quarter of the preceding year.

For both methods, sales tax participants must also electronically pay the balance of their monthly tax liability for days 23 through the end of the month by the PrompTax due date in the succeeding month.

Reporting Format: Payment is made via the NY PrompTax filing calendar. Prepayment amounts remitted through this filing calendar flow to the NY ST810 quarterly return as prior payments.

Set-Up Instructions: Add the NY PrompTax filing calendar. Calculate the prepayment amount externally and enter the amount as a prepayment adjustment.

Filing Method: Manual web file.

ST-330

Use this prepayment method if the client files the NY ST100 or NY ST101 return and chooses to make an advance payment toward their sales tax liability.

Determination Period Range: June to May.

Requirement Threshold: No threshold requirements.

Frequency: Inverse quarterly.

Due Date: By the 20th of the month.

State-Approved Calculation Methods: None specified.

Reporting Format: Payment is made via the NY ST330 filing calendar. Prepayment amounts remitted through this filing calendar flow to the NY ST100 or NY ST101 returns as a prior payments credit.

Set-Up Instructions: Add the NY ST330 filing calendar. The default prepayment percentage is 100%, meaning the prepayment is calculated as 100% of the current month's liability.

If a full year of transaction data hasn't been imported, calculate the prepayment amount externally and enter the amount as a prepayment adjustment.

Filing Method: Manual web file.

For detailed breakdowns of all states that require prepayment, consult the Avalara website here.

3. Strategic Decisions in Sales Tax Management

Effective sales tax management is critical for businesses aiming to optimize their tax obligations and reduce exposure to penalties. Strategic decisions related to physical presence, employment, inventory, and third-party relationships can significantly impact a company’s sales tax nexus and liability. By making informed operational decisions, businesses can navigate the complexities of sales tax regulations more effectively.

How Informed Operational Decisions Can Optimize Sales Tax Nexus Implications

- Physical Presence: Physical presence in a state, such as having a brick-and-mortar store, office, or warehouse, creates sales tax nexus. This means the business is required to collect and remit sales tax in that state. Companies should carefully evaluate their expansion plans, considering the sales tax implications of establishing a physical presence in new locations.

- Employees: Having employees in a state, whether they are sales representatives, support staff, or remote workers, can establish a sales tax nexus. Businesses must account for the tax obligations that arise from employing personnel in different states. Strategic decisions regarding hiring and the location of employees can help manage and minimize these tax liabilities. (In today’s economy where more companies are employing remote employees, we are seeing many more clients trip into physical presence nexus.)

- Inventory: Storing inventory in a state, either in company-owned warehouses or through third-party logistics providers, also triggers a sales tax nexus. Businesses should consider the tax impact when deciding on warehousing and inventory management strategies. Efficiently managing inventory locations can help optimize sales tax obligations. (Note that programs like Fulfillment by Amazon can also create inventory in states that you may not have planned for. It’s important to consider the costs/benefits of using these types of programs.)

- Third-Party Contractors and Services: Engaging third-party contractors, such as those providing white-glove delivery services or installation, can create a nexus if these contractors operate in a state where the business does not otherwise have a physical presence. It’s essential to understand how these relationships affect sales tax responsibilities and to structure contracts and services accordingly.

- Software and Digital Products: Selling software or digital products can complicate sales tax obligations, especially with varying state regulations on digital goods. Companies must stay informed about how different states tax software sales and ensure compliance with these rules. For more detail on calculating and collecting sales tax for software and digital products, read this article we wrote.

4. Leveraging Sales Tax Incentives for Purchases made

One effective strategy to minimize tax exposure for businesses is leveraging available sales tax incentives. By identifying and utilizing these incentives, companies can often significantly reduce the amount of sales tax they pay on specific purchases, , leading to substantial savings and enhanced competitiveness.

Identifying and Utilizing Sales Tax Incentives to Minimize Liability

Sales tax incentives are designed to encourage certain activities within a state, such as manufacturing, renewable energy adoption, and environmental conservation. Here are some key incentives businesses should consider:

- Manufacturing Exemptions: Many states offer sales tax exemptions on equipment used in manufacturing. These exemptions aim to promote industrial growth and retain jobs within the state. Many states offer a full exemption of sales tax for the purchase of qualifying equipment. However, it's crucial to note that not all states provide full exemptions; some may only offer partial relief.

For example, California offers just a partial sales tax exemption for manufacturing and research and development equipment, which can still significantly lower the cost of acquiring necessary machinery.

- Solar and Renewable Energy Exemptions: To incentivize the adoption of clean energy, several states provide sales tax exemptions for solar energy systems and other renewable energy equipment. These incentives not only reduce upfront costs for businesses investing in sustainable practices but also align with broader environmental goals.

- Energy Efficiency Exemptions: Similar to renewable energy incentives, some states offer exemptions for energy-efficient equipment. This can include items like HVAC systems, energy-efficient lighting, and other technologies that reduce a business’s overall energy consumption.

- Electric Vehicles (EV) Exemptions: With the increasing push towards electric vehicles, some states are now offering sales tax exemptions for EV purchases. Businesses that integrate electric vehicles into their fleet can benefit from these incentives, further reducing operational costs.

- Recycling Equipment Exemptions: States like Ohio provide sales tax exemptions for equipment used in recycling. This not only encourages environmentally responsible practices but also reduces the financial burden on businesses adopting sustainable waste management solutions.

It’s important to note that in all the cases mentioned above, states will generally require the purchaser of the qualified equipment to provide an exemption certificate to the seller. These exemptions can come in varying forms across the states, so it’s important for the seller to properly maintain these exemptions in case of an audit.

Effectively managing sales tax liability requires a proactive and informed approach. By understanding the nuances of sales tax nexus, calculating liabilities accurately, making strategic operational decisions, navigating new laws, and leveraging available incentives, businesses can minimize tax exposure and ensure compliance.

Staying informed about the evolving regulatory landscape and seeking professional guidance are essential steps in this process. For expert assistance in navigating the complexities of sales tax nexus and optimizing your tax strategy, come to Miles Consulting Group - book a consultation, drop us a line, or send us an email at info@milesconsultinggroup.com.

As sales tax laws continue to change, businesses must remain vigilant and adaptable, ready to implement best practices in sales tax management. By doing so, you can mitigate risks, optimize your tax position, and focus on what you do best: growing your business.

Keeping Up With Sales Tax Law: A Primer for Businesses

Understanding sales tax laws is crucial for any business operating in the United States. Sales tax regulations are not only complex but also continuously evolving, making it essential for businesses to stay informed and compliant. Failure to adhere to these laws can, of course, result in significant penalties and financial liabilities, but we’re here to show you that it’s possible to get your arms around the complexities, as long as you have a roadmap.

Sales tax laws are changing constantly, but the basics tend to stay the same. Specific areas, such as digital goods, software, and books, may change more frequently. Understanding the critical nature of these changes is vital for businesses to stay compliant. Additionally, the expanding base of sales tax now includes hot areas such as digital advertising and services. Here’s what we’ll be covering:

- Basics of Business Sales Tax

- Sales Tax Definition: A consumption tax collected by the seller and remitted to the tax authority.

- Taxable Items: Typically tangible personal property like furniture, electronics, and clothing.

- Service Taxability: Varies by state; e.g., CPA services might not be taxable, while dry cleaner services might be.

- Exemptions: Includes sales for resale, to government entities, non-profits, educational institutions, and certain agricultural products.

- Sales Tax Thresholds and Compliance

- Economic Nexus Thresholds: Vary by state, often based on sales volume or transaction count.

- Example: $100,000 in sales or 200 transactions annually.

- Physical Presence Considerations: Payroll and HR contributions to physical nexus.

- Tracking Compliance: Importance of being aware of varying sales tax rates and thresholds.

- Obtaining and Using a Sales Tax Permit

- Registration Process: Involves registering with state tax authorities and possibly paying a fee.

- Proper Management: Displaying the permit if required, collecting sales tax accurately, and maintaining detailed records.

Not what you’re looking for? Let’s talk. Reach out to us at info@milesconsultinggroup.com.

1. Basics of Business Sales Tax

Sales tax is a consumption tax imposed by the government on the sale of goods and services. It is typically collected by the seller from the consumer at the point of sale and then remitted to the appropriate tax authority. The scope of what is subject to sales tax varies widely across different states, with each state having its own set of rules and exemptions.

In general, tangible personal property (a buzzword in sales tax discussions) such as furniture, electronics, and clothing, is subject to sales tax. As a general rule, tangible items (things you can touch or feel) typically are taxable unless an exemption applies. However, services, largely intangible, can follow different paths depending on the state's laws. For example, a CPA's services might not be taxable, while a dry cleaner's services might be. Businesses must look to state laws to determine what applies to their specific products and services. As states look to increase their tax bases (and subject more things to sales tax), they often expand to additional services. So, it’s important for companies not to assume that services are exempt from sales tax.

Exemptions

Typical exemptions can include:

- Sales for resale

- Sales to government entities

- Sales to non-profit organizations

- Sales to educational institutions

- Certain agricultural products

Note that the exemptions above generally require the purchaser to issue to the seller an exemption certificate or form of some type. The documentation will vary state by state and exemption by exemption. The burden of proof remains with the seller to ensure that they maintain the proper documentation in case of an audit. As such, understanding which items and services are taxable and recognizing potential exemptions are foundational to ensuring compliance. Keeping abreast of changes in state laws regarding taxable items and services is crucial for businesses to avoid unnecessary tax liabilities. And that’s where Miles Consulting can step in to help, so that you’re not caught unaware. Click here to book a consultation.

2. Sales Tax Thresholds and Compliance

Understanding sales tax thresholds (which create nexus) and ensuring compliance is crucial for businesses operating in multiple states. Each state has its own rules and thresholds for sales tax, which can significantly impact a business's operations and tax obligations. These are the nuances of sales tax thresholds, how they affect businesses, and the importance of meticulous tracking and compliance. For more on how to understand nexus thresholds by state, read this article we wrote.

Explanation of Sales Tax Thresholds in Different States

Sales tax thresholds determine when a business must begin collecting and remitting sales tax in a particular state. These thresholds can be based on either physical presence (physical nexus) or economic activity (economic nexus).

- Physical Presence (Physical Nexus): Physical presence refers to a business having a tangible connection to a state, such as owning or leasing property, having employees, or maintaining inventory within the state. Traditionally, physical presence was the primary factor in establishing sales tax nexus.

- Economic Nexus: Economic nexus thresholds are based on a business's sales volume or the number of transactions within a state, regardless of physical presence. After the landmark 2018 Supreme Court decision in South Dakota v. Wayfair, Inc., many states adopted economic nexus laws, which require out-of-state businesses to collect sales tax if their sales exceed certain thresholds. These thresholds vary by state but commonly range from $100,000 to $500,000 in annual sales or a specific number of transactions (e.g., 200 transactions).

How These Thresholds Impact Business Operations

Sales tax thresholds can have significant implications for business operations. Here’s how they affect different aspects of a company:

- Expansion and Market Entry: When entering new markets, businesses must consider the sales tax thresholds of the target states. Meeting or exceeding these thresholds means the business will need to register for sales tax, collect it from customers, and remit it to the state. This adds a layer of complexity and cost to market expansion plans.

- Compliance Burden: The compliance burden increases as businesses expand their footprint. They must keep track of sales in each state to determine if they meet or exceed the economic nexus thresholds. Physical presence must also be meticulously tracked, as sales tax software often struggles to account for factors like employee locations, inventory, and third-party contractor activities.

- Manual Tracking Requirements: While sales tax software can automate many aspects of tax calculation and remittance, it often falls short in tracking physical nexus components such as payroll, HR records, and physical assets. Businesses must manually track these elements to ensure comprehensive compliance. This requires close coordination between finance, HR, and operations departments. As in most cases, the human touch is vital when it comes to tax – we are that human touch. Book a consultation.

3. Obtaining and Using a Sales Tax Permit

To legally collect and remit sales tax, businesses must obtain a sales tax permit from each state where they have a sales tax obligation. The process typically involves registering with the state's tax authority, providing necessary business information, and sometimes paying a registration fee.

Once a sales tax permit is obtained, it is essential to manage and use it correctly. This includes displaying the permit at the business location, if required, and ensuring that sales tax is collected accurately on all taxable transactions. Businesses should also maintain detailed records of sales and tax collected, as this documentation is vital for filing returns and in the event of an audit.

Keeping up with sales tax laws is an ongoing responsibility for businesses operating in the U.S. The dynamic nature of these regulations requires continuous education and adaptation. By understanding the basics of sales tax, complying with state-specific thresholds, obtaining and properly managing sales tax permits, utilizing modern software solutions, businesses can navigate the complexities of sales tax compliance with confidence.

And then remember, you don’t have to go at it alone - seeking professional advisory services when necessary is your most vital step in every tax endeavor.

Come to Miles Consulting Group - book a consultation, drop us a line, or send us an email at info@milesconsultinggroup.com.

Calculating Your Sales Tax Liability: A Step-by-Step Guide

Calculating Your Sales Tax Liability in the US: A Step-by-Step Guide for International Businesses

We all know that there will always be one surefire aspect to business – and that’s taxes. But the question then is: are you sure, wherever you operate as a business, that you know your tax liability? It can be a messy matter, especially if you’re an international business operating in the US. And that’s what we’ll be talking about here – this guide is specifically tailored to help foreign businesses understand the essential steps involved in calculating sales tax in the US.

Navigating the US tax system can be particularly challenging for international businesses. The US has a complex and varied approach to sales tax, which differs significantly from the VAT systems common in many other countries. For foreign companies, understanding these nuances is essential to ensure compliance, avoid penalties, and accurately calculate sales tax liabilities. So, whether you’re selling products or services in all, many, or a few states, determining the correct amount of sales tax to collect and remit will ensure you stay on the right side of tax authorities, and compliant as an international business in the US.

Here’s what we’ll be covering:

- Understanding Sales Tax Rates – Explore the variability of sales tax rates across US states and localities with examples.

- Finding the Correct Sales Tax Rate – Learn how to determine the correct sales tax rate by identifying the sale location and checking state and local rates.

- The Sales Tax Calculation Formula – Discover the formula for calculating sales tax and see a practical example applied step-by-step.

- Calculating Sales Price with Tax – Understand the methodology for determining a sales price that includes tax, with a detailed example.

- Backward Sales Tax Calculation – Learn how to calculate the pre-tax sales price from a total price that includes sales tax.

- State and Local Sales Tax Rates, 2024 – Get a breakdown of state and local tax rates for the year 2024.

- Using Sales Tax Calculators – Find out how to leverage automated sales tax calculators for accuracy and compliance, with recommended tools and steps.

Not what you’re looking for? Let’s talk. Reach out to us at info@milesconsultinggroup.com.

1. Understanding Sales Tax Rates

Sales tax rates in the United States vary widely across states and localities. Each state sets its own base sales tax rate, which can be supplemented by local taxes imposed by counties, cities, or special districts. For example, California has a state sales tax rate of 7.25%, but local jurisdictions can add their own rates, resulting in a total rate that can exceed 10% in some areas.

Note: Some states just have a state rate, while others include county or special assessment rates, resulting in a combined overall percentage.

2. Finding the Correct Sales Tax Rate

To determine the correct sales tax rate for your business:

- Identify the location of the sale: This includes where the product is delivered or where the service is performed.

- Check state and local tax rates: Use resources such as state tax authority websites or online databases to find current rates. Just to make things a little easier though, we’ve compiled the latest rates for you in a table a little further on – keep reading.

- Apply the rate to your sale: Ensure that you use the combined state and local rate for the transaction’s location.

3. The Sales Tax Calculation Formula

Calculating sales tax involves a straightforward formula:

Sales Tax=Sales Price×Sales Tax Rate

Step-by-Step Guide

- Determine the Sales Price: The price of the product or service before tax.

- Identify the Sales Tax Rate: Use the correct combined state and local rate.

- Multiply the Sales Price by the Sales Tax Rate: This gives you the amount of sales tax to collect.

- Add the Sales Tax to the Sales Price: This gives you the total price that the customer pays.

4. Calculating Sales Price with Tax

Sometimes, you need to determine the sales price inclusive of tax, especially in retail settings where prices are displayed with tax included.

Note: In California, certain disclaimers like ‘we pay your sales tax’ mean the seller is choosing not to collect sales tax at the point of sale, but the tax is still due, representing a liability that needs to be considered.

Methodology

To find the total sales price with tax included:

Total Price=Sales Price×(1+Sales Tax Rate)

Example:

With a sales price of $100 and a tax rate of 8.875%:

Total Price=$100×(1+0.08875)=$100×1.08875=$108.88

5. Backward Sales Tax Calculation

In some scenarios, you might need to work backwards from a total price that includes sales tax to determine the original sales price and the amount of tax included.

To find the pre-tax sales price:

Example

If the total price paid is $108.88 and the sales tax rate is 8.875%:

These formulae and methodologies can be applied universally, regardless of the sales tax rate or the initial sales price, ensuring accurate calculations for both inclusive and exclusive tax scenarios.

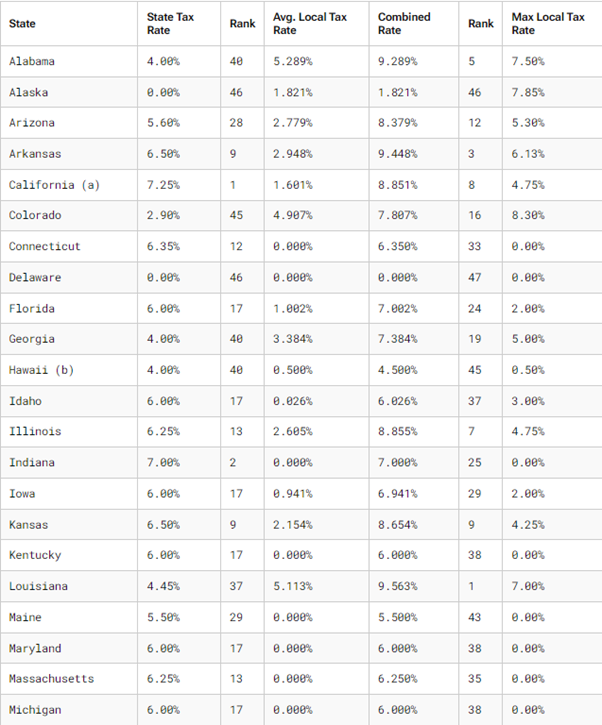

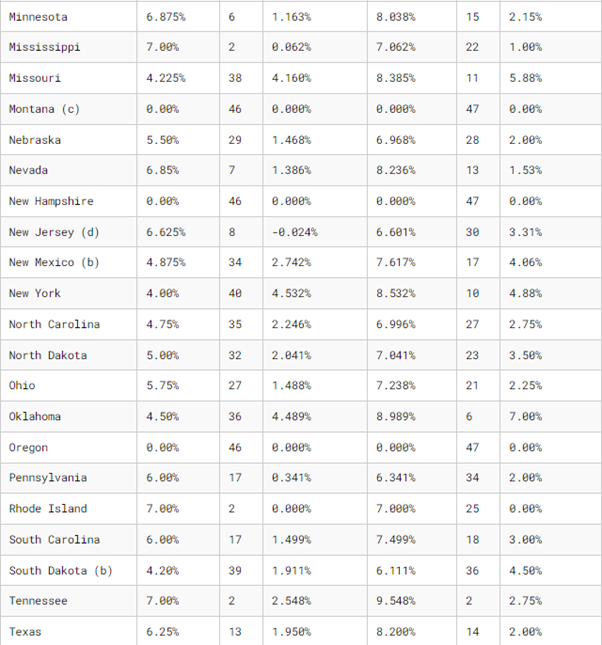

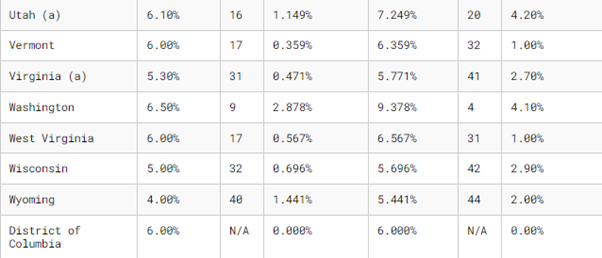

6. State and Local Sales Tax Rates, 2024

A breakdown of average state, local and combined tax rates.

Remember, though, these percentages are subject to change on a regular basis. Always be tax-savvy – check these rates regularly to avoid unpleasant surprises at filing time.

Note: City, county and municipal rates vary. Local rates are weighted by population to compute an average local tax rate.

(a) Three states levy mandatory, statewide, local add-on sales taxes at the state level: California (1.25%), Utah (1.25%), and Virginia (1%). We include these in their state sales tax.

(b) The sales taxes in Hawaii, New Mexico, and South Dakota have broad bases that include many business-to-business services.

(c) Special taxes in local resort areas are not counted here.

(d) Salem County, N.J., is not subject to the statewide sales tax rate and collects a local rate of 3.3125%. New Jersey’s local score is represented as a negative.

Sources: Sales Tax Clearinghouse; Tax Foundation calculations; State Revenue Department websites.

Source: Tax Foundation

7. Using Sales Tax Calculators

Automated tools can significantly simplify the task of calculating sales tax, especially for businesses operating in multiple jurisdictions. These tools ensure compliance with varying tax rates and regulations across different locations. (We’ve been around long enough that some of our clients have done calculations manually…but those days are pretty far behind us!)

While automated sales tax calculators, such as those provided by Avalara, QuickBooks, and TaxJar, and through sales portals like Shopify offer robust solutions, human oversight is essential for accuracy. This is necessary to account for potential changes in tax laws and local regulations that automated systems might not immediately reflect. The human touch is vital, and that’s where Miles Consulting can help.

How to Use Sales Tax Calculators

- Choose a Reliable Calculator:

- Look for calculators provided by reputable sources such as tax authority websites, accounting software, and well-known online resources. It’s important to choose tools that are regularly updated to reflect the latest tax rates and rules.

- Example calculators include those offered by state departments of revenue, accounting software like QuickBooks, and dedicated tax services like Avalara and TaxJar.

- Input Sales Data:

- Enter the sales price of the product or service.

- Provide the necessary location details where the sale occurs (i.e.; if brick and mortar – then at the store; if in e-commerce, the “ship to” address). This includes the state, county, and city, as local tax rates can vary significantly.

- Verify the Results:

- After entering the data, review the results to ensure the calculator has applied the correct combined state and local tax rates.

- Cross-reference with official tax rate information from state or local tax authority websites to confirm accuracy.

By leveraging these tools, businesses can streamline their sales tax calculation processes, reduce errors, and ensure compliance with tax regulations across multiple jurisdictions. However, always remember to periodically verify the accuracy of these tools and stay informed about changes in tax laws that may affect your business.

And we’ve said it before, but we’ll say it again, it’s always better to first consult with a human. Come to Miles Consulting Group – book a consultation, drop us a line, or send us an email at info@milesconsultinggroup.com.

Sales Tax & California’s 80/80 Rule

Navigating Restaurant Sales Tax with the 80/80 Rule and Automation

Running a restaurant comes with its fair share of challenges, and one of the often-overlooked complexities is sales tax. Failure to navigate the intricacies of sales tax regulations can lead to costly fines and penalties. California Regulation 1603 and its 80/80 rule stands out as a key determinant in sales tax application for food establishments.

In this article, we’ll unpack the 80/80 rule when applied to sales tax, explain how it works, and how you can ensure all your bases are covered, with regard to your business’s compliance. Here’s what you can learn:

- Understanding the 80/80 Rule: Explains the 80/80 rule in restaurant sales tax, determining tax application for food sales.

- The Nuance of Restaurant Taxes: Discusses the complexities of restaurant tax compliance, considering factors like food temperature and sales method.

- The Role of Automation in Tax Compliance: Highlights the use of automation solutions, like Avalara, to manage sales tax compliance efficiently in restaurants.

Looking for something else? Let’s talk. Reach out to us at info@milesconsultinggroup.com.

1. Understanding the 80/80 Rule

The world of taxation can be a confusing one. Tax codes are thick with rules and regulations that can be applied a number of different ways.

Case in point: the 80/80 tax rule for restaurants.

The 80/80 rule serves as a crucial guideline in determining whether sales tax applies to food sales. It comes into play when more than 80% of a business's revenue is generated from food sales, and over 80% of those sales are taxable, for example, from food consumed on-premises or served hot.

2. The Nuance of Restaurant Taxes

Despite the apparent simplicity of the 80/80 rule, nuances in tax regulations complicate compliance. Factors such as the temperature of the food and the method of sale—whether in-house dining, takeout, or delivery—can influence tax obligations. This complexity underscores the importance of thorough understanding and adherence to tax laws to avoid legal repercussions.

Here’s a breakdown:

Hot vs. Cold: Tax Distinctions

Tax regulations often distinguish between hot and cold food items, each carrying its own set of tax obligations. Hot meals may be subject to different tax rates or exemptions compared to cold items, introducing a crucial consideration for restaurant owners.

So, let’s say you’re the owner of a coffee shop. A customer orders a pastry and wants it heated up. You’ll likely have to charge them sales tax. Now, what about if another customer orders a cold sandwich? Sales tax may not apply in this situation based on the 80/80 rule. However, things get complicated once you start plugging different numbers into the equation. For instance, different rules may apply if less of your revenue comes from food sales, but most of what you do sell is hot.

Method of Sale: Dining, Takeout, or Delivery

Furthermore, the method of sale also impacts tax liabilities. Whether customers dine in, opt for takeout, or have their meals delivered can influence the applicable taxes.

Top of Form

3. The Role of Automation in Tax Compliance

You can see how things get complicated in a hurry. The takeout (pun intended) is, as a business owner, it’s your responsibility to know the tax codes and how they relate to you.

In addressing these complexities, restaurant owners can turn to automation solutions. Companies like Avalara offer automated platforms tailored to manage sales tax compliance efficiently. Automation ensures accurate calculation of sales tax, facilitates the management of varying tax rates for different sales channels, and streamlines tax reporting, particularly for transactions through third-party ordering platforms.

First, Seek Professional Advice

Always seek professional advice, though, before you automate your processes. Given the complexities of food sales tax regulations, businesses will always benefit more from consulting tax professionals who specialize in sales tax compliance. Experts can provide guidance tailored to specific business needs and help navigate food sales tax laws – especially when it comes to matters of high complexity, such as the 80/80 rule. Miles Consulting is your expert - we’ll guide you to a clearer tax solution, every time.

Come to Miles Consulting Group - book a consultation, drop us a line, or send us an email at info@milesconsultinggroup.com.

2024 Finance Leader Survey for SaaS and Tech CFOs

Don't Go It Alone: The 2024 Finance Leader Survey Connecting CFOs Across the SaaS and Technology Industries

Over the last few months, Miles Consulting Group, have been working on our first annual Finance Leader Benchmarking Survey for the SaaS and technology industry. This comprehensive survey aims to gather valuable insights from CFOs and senior finance professionals, providing a robust data set that will support and empower financial leaders across the sector.

If you're a CFO or a senior finance leader working in the SaaS or tech industry, I strongly encourage you to participate. By taking just 5 minutes to complete the anonymous questionnaire, you'll not only contribute to a valuable industry resource but also gain access to exclusive insights that can inform your strategic decision-making.

Click here to take part in the survey now.

At Miles, we understand the unique challenges that finance leaders face daily and have firsthand experience of how lonely the role can be at times – you're often the only one at the company with your specific responsibilities, carrying immense pressure as rules, regulations, and economic conditions constantly shift. Wouldn't it be invaluable to benchmark your experiences and priorities against those of your peers at similar companies?

That's precisely what this survey aims to achieve. By aggregating data from finance leaders across the SaaS and tech landscape, we'll uncover trends, best practices, and areas of concern that you can use to calibrate your approach and drive better outcomes for your organization.

Already, the preliminary survey results are revealing fascinating insights. 68% of respondents to date have experienced moderate or significant growth in the last year compared to previous years. Additionally, 38% express moderate or significant concern about their company's state sales tax matters this year. Revenue growth, retention, cash flow management, and operational efficiency are emerging as the top three priority areas for CFOs currently.

These are just a glimpse of the valuable data points our survey is uncovering. By participating, you'll gain access to the full report, enabling you to benchmark your organization's performance, priorities, and challenges against those of your industry peers.

Don't miss this opportunity to contribute to and benefit from this invaluable resource. If you're a CFO or senior finance leader in the SaaS or tech industry, please take a few moments to complete the anonymous survey. Together, we can shed light on the unique experiences and challenges faced by financial leaders, fostering a more connected and empowered community.

Take the survey now. Click here.

We'd like to extend our appreciation to those who have already completed the survey. Your participation is invaluable in building a comprehensive understanding of the finance leader landscape.

Let's work together to create a more informed, connected, and successful SaaS and tech finance community. We look forward to your participation and to sharing the insightful findings with you next month.

Does Economic Nexus Last Forever? What You Need To Know About Trailing Nexus

The June 2018 U.S. Supreme Court ruling in South Dakota v. Wayfair, Inc. reshaped the landscape of sales tax obligations across the United States, ushering in the era of economic nexus. This landmark decision overturned the previous requirement of physical presence for establishing nexus, opening the door for states to enact economic nexus legislation. Alongside this shift, a new focus on the concept of trailing nexus emerged, presenting a continuation of tax obligations even after a business no longer meets the nexus criteria.

In this article, we’ll define economic nexus and trailing nexus, and how the two may dictate your tax obligations regarding the states in which you operate. Here’s what we’ll cover:

- Understanding Economic Nexus and Thresholds: Discusses economic nexus thresholds and varying state regulations.

- What Is Trailing Nexus? Defines trailing nexus.

- Examples of Trailing Nexus Policies: Explores examples of trailing nexus policies by state.

- Practical Considerations for Businesses: Discusses tips on how to handle trailing nexus in your state.

Not what you’re looking for? Let’s talk. Reach out to us at info@milesconsultinggroup.com.

1. Understanding Economic Nexus and Thresholds

Economic nexus, as per the nexus definition, refers to the connection between a business and a state based on economic activity rather than physical presence. Each state sets its own threshold for economic nexus, determining when a business is required to collect and remit sales tax. For instance, in Arkansas, the nexus law sets the threshold at $100,000 in sales or 200 separate transactions, whereas in California, it's $500,000. These thresholds vary significantly from state to state, adding complexity to sales tax compliance for businesses operating across multiple jurisdictions.

2. What Is Trailing Nexus?

Several states have a policy referred to as “trailing nexus,” where even when a threshold is no longer met, you must still collect and remit sales tax for a certain amount of time. Not all states have trailing nexus, and for those that do, the amount of time you are obligated can vary.

3. Examples of Trailing Nexus Policies

California Trailing Nexus Policy

California's trailing nexus policy mandates that retailers with either a physical presence or economic nexus in the state must maintain registration for the calendar year in which nexus-creating activities occurred and the subsequent calendar year.

Washington State Trailing Nexus Policy

In Washington state, WAC 458-20-193 outlines their trailing nexus policy, stating that businesses ceasing operations that created nexus within the state are still subject to taxation for the remainder of the calendar year in which the activities ceased, along with the following calendar year.

Other States with Trailing Nexus Policies

States like Arizona, Massachusetts, Michigan, and Texas also enforce trailing nexus rules, necessitating businesses to remain compliant with tax obligations even after ceasing relevant activities.

States without Trailing Nexus Policies

Conversely, certain states explicitly do not impose trailing nexus rules. Examples include Florida, Connecticut, Idaho, New York, and the District of Columbia.

States with Varied Trailing Nexus Policies

Some states have ambiguous trailing nexus policies, with enforcement dependent on specific circumstances. This category includes states such as Colorado, Georgia, Hawaii, and Illinois.

4. Practical Considerations for Businesses

Deciding whether to maintain sales tax registration in a state where nexus criteria are no longer met involves careful consideration. Businesses are advised to take a long-term view of their nexus obligations, considering potential future sales and the impact on compliance processes.

For example, consider a scenario where a company surpasses economic nexus thresholds in one year, falls below them in the next, and then meets them again in the third year. Our recommendation is to adopt a forward-thinking approach and assess whether the company genuinely anticipates the cessation of nexus within the next few years. If a company registers for a year, then cancels its registration, only to re-register shortly afterward, it not only disrupts the compliance process but also raises red flags for potential audits by the state authorities. States generally prefer consistency in tax filings. Even in states without trailing nexus policies, it may be prudent to submit "zero returns" to confirm the cessation of business activities in that state. However, companies should generally refrain from continuing to file in states where the nexus was created solely based on minimal connections, such as having one employee or a couple of significant transactions, if they do not expect further business operations in that jurisdiction. In such cases, withdrawing from filing obligations is likely the appropriate course of action. As is often the case with matters involving multiple states, the optimal approach depends on the specific circumstances of each client.

Understanding trailing nexus policies is essential for businesses navigating multi-state sales tax compliance. As regulations evolve and enforcement varies, staying informed and seeking expert guidance are crucial. This is what we do - provide expertise in navigating economic nexus, trailing nexus, and then tailored solutions to help ensure your business is compliant. It’s a complex issue, but you don’t have to go at it alone. Come to Miles Consulting Group - book a consultation, drop us a line, or send us an email at info@milesconsultinggroup.com.

Explaining Nexus Threshold By State

Understanding the intricate web of sales tax nexus thresholds is key for businesses navigating the complexities of state taxation laws. As the digital age continues to reshape traditional business models, the concept of nexus—the connection between a business and a taxing jurisdiction—has become a focal point in determining tax obligations. Nexus can be created by physical presence (i.e.; employees or contractors in a state, an office, or inventory) or economic .

The table below aims to shed light on the diverse nexus thresholds established by individual states across the United States when determining economic nexus for sales tax. Each state presents its own set of criteria that trigger nexus for sales, income, and other tax purposes. By delineating these thresholds, businesses can proactively strategize their operations to ensure compliance and mitigate potential liabilities.

As a business operating in one, or many, of these states, its truly vital that you have clear knowledge of their tax regulations and nexus thresholds.

Things can get a little messy in these matters, so consult the below table, consider your individual fact pattern and then come to Miles Consulting – we’ll help you understand your unique tax challenges, whatever state you’re in. Our professionals can help with sales tax compliance (filing returns when and where you need to), retroactive remediation, merger and acquisition due diligence, and audit support, among others.

We start most conversations with clients by talking about nexus because that determination is the starting point of a relationship with a state and its taxing authority. Once nexus is established, a company has an obligation to then determine if its products and services sold to customers in that state are subject to sales tax, whether there are relevant exemptions, and then their requirements to file sales tax returns. Nexus is just the first step in the process of becoming compliant.

The chart below is a great starting point…and then we can help you apply it to your situation. Contact us for a conversation about your situation and how we can help.

Book a consultation with Miles Consulting, drop us a line, or send us an email at info@milesconsultinggroup.com.

| Economic Nexus Threshold for Sales Tax | |||||||

| State | Effective date | Economic nexus threshold | Time period the threshold is based on | Inclusions/exclusions from the remote seller's threshold calculation | Is registration required if all sales are marketplace sales? | ||

| Alabama | 10/1/2018 | Monetary: $250,000 Transaction: N/A | Previous calendar year | Type of sales to include: Retail sales Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Include |

No | ||

| Alaska | 4/1/2020 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Arizona | 10/1/2019 | Monetary: 10/1/2019 $200,000 1/1/2020 $150,000 1/1/2021 $100,000 Transaction: N/A | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Exclude Sales for resale: Include | No | ||

| Arkansas | 7/1/2019 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: The sale of TPP, taxable services, a digital code, or specified digital products Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Exclude |

No | ||

| California | 4/1/2019 | Monetary: 4/1/2019 $100,000 4/26/2019 $500,000 Transaction: N/A | Previous or current calendar year | Type of sales to include: Total combined sales of TPP Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Colorado | 6/1/2019 | Monetary: $100,000 Transaction: N/A | Previous or current calendar year | Type of sales to include: Retail sales Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Include |

No | ||

| Connecticut | 12/1/2018 | Monetary: 12/1/2018 $250,000 7/1/2019 100,000 AND Transaction: 200 | 12-month period ending on September 30th | Type of sales to include: Monetary portion of the threshold: gross sales AND Transaction portion of the threshold: retail sales Sales through a marketplace: Include for both monetary and transaction portion Sales for resale: Exclude for transaction portion, but include for monetary portion Exempt sales: Include for both monetary and transaction portion | Yes | ||

| District of Columbia | 1/1/2019 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Retail sales Sales through a marketplace: Include Sales for resale: Exclude Exempt sales: Include |

No | ||

| Florida | 7/1/2021 | Monetary: $100,000 Transaction: N/A | Previous calendar year | Type of sales to include: Retail sales of TPP Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Exclude |

No | ||

| Georgia | 1/1/2019 | Monetary: 1/1/2019 $250,000 1/1/2020 $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Retail sales of TPP Sales through a marketplace: Include Sales for resale: Exclude Exempt sales: Include |

No | ||

| Hawaii | 7/1/2018 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Gross sales of TPP, services, and intangibles Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

Yes | ||

| Idaho | 6/1/2019 | Monetary: $100,000 Transaction: N/A | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Illinois | 10/1/2018 | Monetary: $100,000 OR Transaction: 200 | Prior 12 months | Type of sales to include: Gross sales of TPP Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Include |

|||

| Indiana | 10/1/2018 | Monetary: $100,000

Transaction: |

Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Exclude Sales for resale: Include Exempt sales: Include |

No | ||

| Iowa | 1/1/2019 | Monetary: $100,000 Transaction: 1/1/2019 200 7/1/2019 N/A | Previous or current calendar year | Type of sales to include: Gross revenue from sales of TPP, services, or specified digital products Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Kansas | 7/1/2021 | Monetary: $100,000 Transaction: N/A | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Kentucky | 10/1/2018 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Louisiana | 7/1/2020 | Monetary: $100,000 | Previous or current calendar year | Type of sales to include: Gross sales of TPP Sales through a marketplace: Exclude Sales for resale: Include Exempt sales: Include |

No | ||

| Maine | 7/1/2018 | Monetary: $100,000 Transaction: 7/1/2018 200 1/1/2022 N/A | Previous or current calendar year | Type of sales to include: The sale of TPP, products transferred electronically, or taxable services Sales through a marketplace: Exclude Sales for resale: Include Exempt sales: Include |

Yes | ||

| Maryland | 10/1/2018 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: The sale of TPP and/or taxable services Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Massachusetts | 10/1/2019 | Monetary: $100,000 Transaction: N/A | Previous or current calendar year | Type of sales to include: Gross sales of TPP and/or services Sales through a marketplace: Exclude Sales for resale: Include Exempt sales: Include |

No | ||

| Michigan | 10/1/2018 | Monetary: $100,000 OR Transaction: 200 | Previous calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Minnesota | 10/1/2018 | Monetary: $100,000 OR Transaction: 10/1/2018 100 10/1/2019 200 | Prior 12 Months | Type of sales to include: Retail sales Sales through a marketplace: Include Sales for resale: Exclude Exempt sales: Include |

No | ||

| Mississippi | 9/1/2018 | Monetary: $250,000 Transaction: N/A | Prior 12 Months | Type of sales to include: Total sales Sales through a marketplace: Exclude Sales for resale: Include Exempt sales: Include |

No | ||

| Missouri | 1/1/2023 | Monetary: $100,000 Transaction: N/A | Previous or current calendar year | Type of sales to include: All sales of tangible personal property Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

|||

| Nebraska | 4/1/2019 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Retail sales Sales through a marketplace: Include Sales for resale: Exclude Exempt sales: Include |

Yes | ||

| Nevada | 10/1/2018 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Retail sales Sales through a marketplace: Include Sales for resale: Exclude Exempt sales: Include |

Yes | ||

| New Jersey | 11/1/2018 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Gross revenue from sales of tangible personal property, specified digital products, or taxable services Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| New Mexico | 7/1/2019 | Monetary: $100,000 Transaction: N/A | Previous calendar year | Type of sales to include: Taxable gross receipts Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Exclude |

Yes | ||

| New York | 6/21/2018 | Monetary: 6/21/2018 $300,000 6/24/2019 $500,000 AND Transaction: 100 | Prior four quarters

|

Type of sales to include: Sales of TPP Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

Yes | ||

| North Carolina | 11/1/2018 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar yea | Type of sales to include: All sales of TPP, digital property, and services Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| North Dakota | 10/1/2018 | Monetary: $100,000 Transaction: 2018 200 2019 N/A | Previous or current calendar yea | Type of sales to include: The sales of TPP and other taxable items delivered in this state Sales through a marketplace: Include Sales for resale: Exclude Exempt sales: Exclude |

No | ||

| Ohio | 8/1/2019 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar yea | Type of sales to include: Retail sales Sales through a marketplace: Include Sales for resale: Exclude Exempt sales: Include |

No | ||

| Oklahoma | 7/1/2018 | Monetary: 7/1/2018 $10,000 11/1/2019 $100,00 Transaction: N/A | Previous calendar year | Type of sales to include: Taxable sales Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Exclude |

No | ||

| Pennsylvania | 7/1/2019 | Monetary: $100,000 Transaction: N/A | Previous Pennsylvania fiscal calendar year - beginning on April 1st | Type of sales to include: Gross sales Sales through a marketplace: Exclude Sales for resale: Include Exempt sales: Include |

No | ||

| Rhode Island | 7/1/2019 | Monetary: $100,000 OR Transaction: 200 | Previous calendar year | Type of sales to include: Gross revenue from the sale of TPP, prewritten computer software delivered electronically or by load and leave, vendor-hosted prewritten computer software, and/or taxable services delivered into the state Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| South Carolina | 11/1/2018 | Monetary: $100,000 Transaction: N/A | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| South Dakota | 11/1/2018 | Monetary: $100,000 OR Transaction: 200 (Transaction threshold to be removed 7/1/23) | Previous or current calendar year | Type of sales to include: Gross sales of TPP, any products or services transferred electronically Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Tennessee | 7/1/2019 | Monetary: 10/1/2019 $500,000 10/1/2020 $100,000 Transaction: N/A | Prior 12 months | Type of sales to include: Retail sales Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Include |

No | ||

| Texas | 10/1/2019 | Monetary: $500,000 Transaction: N/A | Prior 12 months | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Utah | 1/1/2019 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Exclude Sales for resale: Include Exempt sales: Include |

No | ||

| Vermont | 7/1/2018 | Monetary: $100,000 OR Transaction: 200 | Prior 12 months | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Virginia | 7/1/2019 | Monetary: $100,000 OR Transaction: 200 | Previous or current calendar year | Type of sales to include: Retail sales Sales through a marketplace: Exclude Sales for resale: Exclude Exempt sales: Include |

No | ||

| Washington | 10/1/2018 | Monetary: $100,000 Transaction: 2018 200 2020 N/A | Previous or current calendar year | Type of sales to include: Retail sales Sales through a marketplace: Include Sales for resale: Exclude Exempt sales: Include |

No | ||

| West Virginia | 1/1/2019 | Monetary: $100,000 OR Transaction: 200 | Previous calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Wisconsin | 10/1/2018 | Monetary: $100,000 Transaction: 10/1/2018 200 2/20/2021 N/A | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

| Wyoming | 2/1/2019 | Monetary: $100,000 OR Transaction: 2/1/2019 200 7/1/2024 N/A | Previous or current calendar year | Type of sales to include: Gross sales Sales through a marketplace: Include Sales for resale: Include Exempt sales: Include |

No | ||

Establishing Presence: A Guide to Sales Tax Nexus Reviews

So, you’re selling a product…to customers…in all states in the US. You’re a US company selling widgets or software or services, or you’re a foreign company selling gadgets – all destined for US customers (whether individual consumers or businesses). Business is growing, sales are increasing. Congratulations!

First next step? Determine if you need to be collecting and remitting sales tax on those sales. Note – you probably do! And that starts with nexus.

When selling to US customers and then dealing with the many sales tax regulations in our 50 states, understanding the concept of nexus is paramount for businesses aiming to stay compliant and avoid potential penalties. Nexus, in essence, refers to the connection or presence that a business has in a particular state, which can trigger the obligation to collect and remit sales tax. However, determining whether a business has established nexus in a given jurisdiction requires a comprehensive assessment known as a nexus review.

What is a nexus review?

A nexus review involves a thorough examination of various factors, including a business's physical presence, economic activities, and digital footprint, to determine whether it has crossed the threshold to trigger sales tax obligations in the state, or states, in which it operates. This process is essential for businesses to assess their compliance status accurately and identify potential areas of risk. By understanding the intricacies of nexus reviews, businesses can proactively manage their sales tax responsibilities and navigate the complexities of multi-state taxation with confidence.

Let’s unpack that here – understanding economic nexus, physical presence, the review process and how to evaluate your business’s nexus requirements. Here’s a breakdown:

- Understanding Economic Nexus & Physical Presence (whichever comes first)

- Economic nexus, triggered by certain criteria, defines a business's virtual presence in a state, necessitating sales tax compliance even without physical presence.

- The Nexus Review Process

- A step-by-step evaluation of a business's activities and transactions to determine sales tax obligations, ensuring accurate compliance assessment.

- Nexus Across Different States

- Variations in state laws necessitate a nuanced understanding of nexus criteria, with some states following Multistate Tax Commission (MTC) guidelines.

Not what you’re looking for? Let’s talk. Reach out to us at info@milesconsultinggroup.com

1. Understanding Economic Nexus